Navigating the world of credit and debt can be confusing, especially when trying to understand the different types. Unsecured credit debt is a common form of debt that many individuals face, but it’s crucial to understand its implications and how it differs from secured debt. This article will delve into the specifics of unsecured credit debt, its characteristics, and what options are available if you find yourself struggling to manage it. Knowing your rights and responsibilities is the first step towards financial stability.

What is Unsecured Credit Debt?

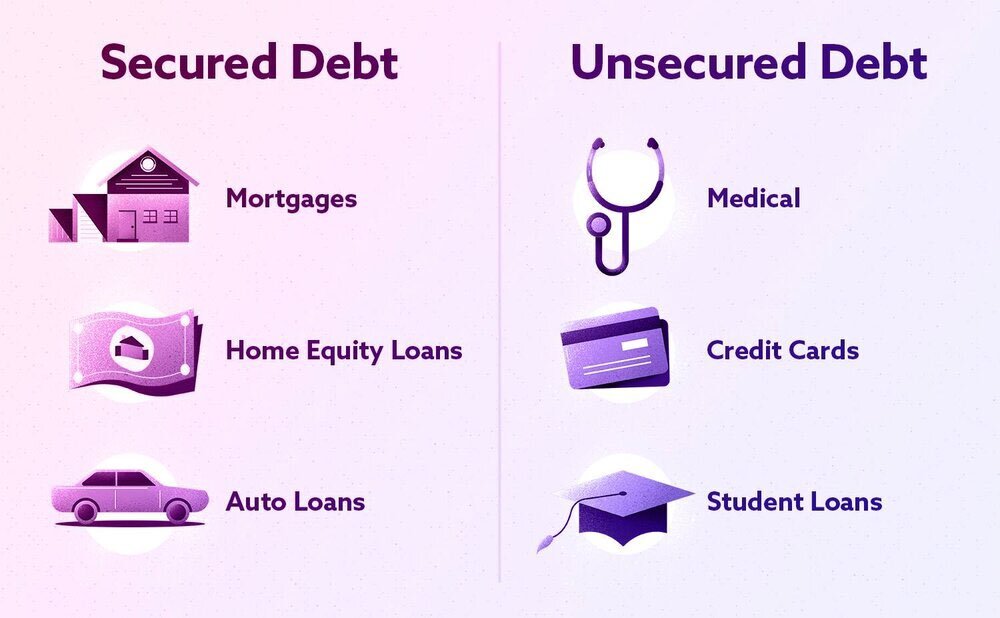

Unsecured credit debt is debt that is not backed by any specific asset or collateral. In other words, if you fail to repay the debt, the lender cannot seize a specific item, like a house or car, to recover their losses. This contrasts with secured debt, where the lender has a lien on a specific asset.

Examples of Unsecured Credit Debt

- Credit card balances

- Personal loans

- Medical bills

- Student loans (in most cases)

These types of debt are based primarily on your creditworthiness and promise to repay. The lender relies on your credit history and income to assess the risk of lending you money.

Risks Associated with Unsecured Credit Debt

While the lack of collateral might seem advantageous, unsecured credit debt comes with its own set of risks.

- Higher Interest Rates: Because lenders take on more risk with unsecured debt, they often charge higher interest rates to compensate.

- Credit Score Impact: Failure to repay unsecured debt can severely damage your credit score.

- Collection Actions: Lenders can pursue legal action to collect unpaid debt, including wage garnishment.

- Lawsuits and Judgments: Unpaid debts can lead to lawsuits and court judgments against you, further complicating your financial situation.

Factoid: The average American household carries over $5,000 in credit card debt. Managing this debt effectively is crucial for financial well-being.

Managing Unsecured Credit Debt

If you’re struggling with unsecured credit debt, several strategies can help you regain control of your finances.

Debt Management Strategies

- Budgeting: Create a detailed budget to track your income and expenses.

- Debt Consolidation: Consider consolidating your debts into a single loan with a lower interest rate.

- Balance Transfers: Transfer high-interest credit card balances to cards with lower rates.

- Negotiation: Contact your creditors and try to negotiate lower interest rates or payment plans.

- Credit Counseling: Seek guidance from a non-profit credit counseling agency.

When to Seek Professional Help

If your debt is overwhelming and you’re unable to manage it on your own, consider seeking professional help from a financial advisor or debt relief agency. They can provide personalized advice and explore options like debt settlement or bankruptcy.

FAQ: Unsecured Credit Debt

Q: What happens if I can’t pay my unsecured credit debt?

A: Your credit score will be negatively impacted, and the lender may pursue collection actions, including lawsuits and wage garnishment.

Q: Can I get rid of unsecured credit debt through bankruptcy?

A: Yes, in most cases, unsecured credit debt can be discharged through bankruptcy. However, there are specific requirements and potential consequences to consider.

Q: How does unsecured debt affect my credit score?

A: Late payments, defaults, and high balances on unsecured credit accounts can significantly lower your credit score.

Q: What is the difference between secured and unsecured debt?

A: Secured debt is backed by collateral, while unsecured debt is not. If you fail to repay secured debt, the lender can seize the collateral.

Q: Is it possible to negotiate with creditors on unsecured debt?

A: Yes, it is often possible to negotiate lower interest rates or payment plans with creditors. It’s worth contacting them to explore your options.

Building a Strong Financial Future

Ultimately, understanding and managing unsecured credit debt is a vital component of building a strong financial future. By taking proactive steps to control your spending, manage your debt responsibly, and seek help when needed, you can avoid the pitfalls of overwhelming debt and achieve your financial goals.

Key Takeaways for Managing Unsecured Debt:

- Prioritize Repayment: Make timely payments to avoid late fees and negative impacts on your credit score.

- Monitor Your Credit: Regularly check your credit report for errors and signs of identity theft.

- Avoid Overspending: Be mindful of your spending habits and avoid accumulating unnecessary debt.

- Seek Education: Continuously learn about personal finance to make informed decisions.

Remember that managing unsecured credit debt is an ongoing process. By staying informed and proactive, you can maintain a healthy financial life and achieve long-term financial security.

Additional Resources

There are numerous resources available to help you better understand and manage your unsecured credit debt. Consider exploring the following:

- Non-Profit Credit Counseling Agencies: These agencies offer free or low-cost financial counseling and education.

- Government Websites: The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) provide valuable information and resources.

- Financial Literacy Websites: Many websites offer articles, tools, and calculators to help you improve your financial literacy.

- Books and Podcasts: Explore books and podcasts on personal finance to gain insights and strategies for managing debt.

Taking the time to educate yourself and seek support can make a significant difference in your ability to manage your unsecured credit debt and achieve your financial goals. Don’t hesitate to reach out for help when you need it. Your financial well-being is worth the effort.

Navigating Debt Relief Options

If you find yourself struggling to manage your unsecured credit debt, it’s crucial to understand the various debt relief options available to you. Each option has its own advantages and disadvantages, so it’s important to carefully consider your individual circumstances before making a decision.

Debt Management Plans (DMPs)

A DMP is a structured repayment plan offered by credit counseling agencies. The agency works with your creditors to negotiate lower interest rates and monthly payments. You make a single monthly payment to the agency, which then distributes the funds to your creditors. DMPs can be a good option if you have a steady income and are committed to making regular payments.

Debt Settlement

Debt settlement involves negotiating with your creditors to pay a lump sum that is less than the total amount you owe. This can be a viable option if you have a significant amount of debt and are unable to afford the minimum payments; However, debt settlement can negatively impact your credit score and may result in tax consequences, as the forgiven debt may be considered taxable income.

Factoid: Successfully negotiating a debt settlement often requires stopping payments to the creditor for a period of time, which will significantly damage your credit score.

Bankruptcy

Bankruptcy is a legal process that allows you to discharge certain debts. There are two main types of bankruptcy for individuals: Chapter 7 and Chapter 13. Chapter 7 involves liquidating non-exempt assets to pay off creditors, while Chapter 13 involves creating a repayment plan. Bankruptcy can provide a fresh start, but it also has serious consequences for your credit score and can remain on your credit report for up to 10 years.

Choosing the Right Option

The best debt relief option for you will depend on your individual circumstances, including the amount of debt you owe, your income, your credit score, and your financial goals. It’s important to carefully research each option and seek professional advice from a financial advisor or credit counselor before making a decision.

Preventing Future Debt Problems

Once you’ve addressed your current unsecured credit debt, it’s important to take steps to prevent future debt problems. This involves developing healthy financial habits and making informed financial decisions.

Creating a Budget

A budget is a plan for how you will spend your money. It helps you track your income and expenses, identify areas where you can cut back, and ensure that you have enough money to cover your essential expenses and debt payments. Creating a budget is the foundation of sound financial management.

Building an Emergency Fund

An emergency fund is a savings account that you can use to cover unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund can prevent you from relying on credit cards or loans to cover these expenses, which can lead to debt problems.

Avoiding Impulse Purchases

Impulse purchases are unplanned purchases that you make on a whim. They can quickly add up and derail your budget. Before making a purchase, ask yourself if you really need it and if you can afford it. Waiting a day or two before making a non-essential purchase can help you avoid impulse buying.

Living Below Your Means

Living below your means means spending less money than you earn. This allows you to save money, pay off debt, and build wealth. Avoid keeping up with the Joneses and focus on your own financial goals.

Long-Term Financial Wellness

Managing unsecured credit debt is just one piece of the puzzle when it comes to long-term financial wellness. To achieve true financial security, it’s important to focus on building wealth, investing wisely, and planning for the future.

Investing for Retirement

Investing for retirement is essential to ensure that you have enough money to live comfortably in your later years. Take advantage of employer-sponsored retirement plans, such as 401(k)s, and consider opening an individual retirement account (IRA). Start saving early and consistently to maximize the power of compounding.

Building a Diversified Portfolio

A diversified investment portfolio includes a variety of asset classes, such as stocks, bonds, and real estate. Diversification helps to reduce risk and increase the potential for long-term growth. Consult with a financial advisor to create a portfolio that is appropriate for your risk tolerance and investment goals.

Planning for the Future

Planning for the future includes setting financial goals, creating a financial plan, and regularly reviewing and updating your plan as your circumstances change. Consider consulting with a financial advisor to help you develop a comprehensive financial plan;

By taking a proactive approach to managing your finances, you can achieve long-term financial wellness and secure your financial future.