Securing a car loan is a significant step for many individuals, allowing them to purchase a vehicle that meets their transportation needs․ However, the process of obtaining a loan can often seem complex, with various factors influencing approval․ One of the most common questions potential borrowers have is whether their income is the sole determinant of loan eligibility․ While income plays a crucial role, it’s important to understand the broader scope of factors lenders consider when assessing loan applications․ Let’s delve deeper into how income interacts with other creditworthiness indicators to determine if you’ll be approved for a car loan․

The Role of Income in Car Loan Approval

Income is undoubtedly a key factor in the car loan approval process․ Lenders need assurance that you have the financial capacity to make regular monthly payments․ A higher income generally indicates a greater ability to repay the loan, making you a less risky borrower in the eyes of the lender․

- Debt-to-Income Ratio (DTI): Lenders calculate your DTI by dividing your total monthly debt payments by your gross monthly income․ A lower DTI is generally preferred, as it suggests you have more disposable income available to cover loan payments․

- Consistent Income: Lenders prefer borrowers with a stable and consistent income stream․ This could be from a full-time job, self-employment, or other reliable sources․

Factoid: The average car loan interest rate can vary significantly depending on your credit score․ A good credit score can save you thousands of dollars over the life of the loan․

Other Factors Affecting Car Loan Approval

While income is important, it’s not the only factor lenders consider․ Your credit history, credit score, and the type of vehicle you’re purchasing also play significant roles․

Credit History and Credit Score

Your credit history is a record of your past borrowing and repayment behavior․ Lenders use this information to assess your creditworthiness․ A good credit score indicates that you have a history of making timely payments and managing credit responsibly․

- Payment History: This is the most important factor in your credit score․ Lenders want to see that you consistently pay your bills on time․

- Credit Utilization: This refers to the amount of credit you’re using compared to your total available credit․ Keeping your credit utilization low (below 30%) can improve your credit score․

Loan Amount and Vehicle Type

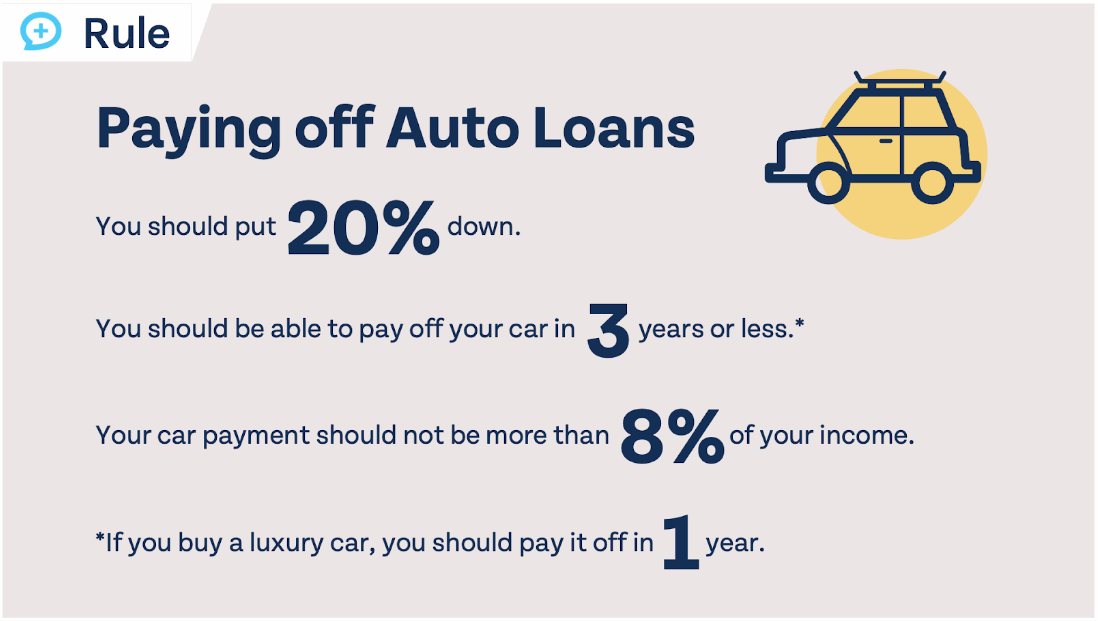

The amount you’re borrowing and the type of vehicle you’re purchasing can also affect your loan approval․ Lenders may be more willing to approve a loan for a less expensive vehicle or if you’re making a larger down payment․

Employment History

A stable employment history demonstrates consistency and reliability to lenders․ Frequent job changes might raise red flags, suggesting potential instability in your income․

Improving Your Chances of Car Loan Approval

If you’re concerned about your ability to get approved for a car loan, there are several steps you can take to improve your chances․

- Improve Your Credit Score: Pay your bills on time, reduce your credit utilization, and avoid opening too many new credit accounts․

- Save for a Down Payment: A larger down payment can reduce the amount you need to borrow and demonstrate your commitment to the loan․

- Shop Around for the Best Rates: Compare offers from multiple lenders to find the best interest rate and terms․

FAQ About Car Loans and Income Q: Can I get a car loan with a low income?

A: Yes, it’s possible, but it may be more challenging․ Lenders will likely scrutinize your credit history and DTI more closely․ Consider a smaller loan amount or a larger down payment․

Q: What is a good debt-to-income ratio for a car loan?

A: Ideally, you want a DTI below 43%․ Lower is generally better, indicating you have more disposable income․

Q: Will a co-signer help me get approved for a car loan?

A: Yes, a co-signer with good credit and a stable income can increase your chances of approval, as they are guaranteeing the loan․

Q: How does my credit score impact my car loan interest rate?

A: A higher credit score typically results in a lower interest rate, saving you money over the life of the loan․

Q: What if I have no credit history?

A: Building credit is essential․ Consider a secured credit card or becoming an authorized user on someone else’s credit card to start establishing a credit history․

Understanding Different Types of Car Loans

Not all car loans are created equal․ Understanding the different types of loans available can help you make an informed decision and choose the option that best suits your needs․

New Car Loans

These loans are specifically for purchasing new vehicles․ They often come with lower interest rates compared to used car loans due to the lower risk associated with a brand-new vehicle․

Used Car Loans

Used car loans are for purchasing pre-owned vehicles․ Interest rates are typically higher than new car loans because used cars are considered a higher risk due to potential maintenance and repair costs․

Refinancing Car Loans

If you already have a car loan, you can refinance it to potentially lower your interest rate or monthly payments․ This can be a good option if your credit score has improved since you initially took out the loan or if interest rates have decreased․

Leasing vs․ Buying

While not technically a loan, leasing is another way to acquire a vehicle․ With a lease, you’re essentially renting the car for a set period and mileage․ At the end of the lease, you can either return the car or purchase it․

Factoid: Leasing a car typically results in lower monthly payments compared to buying, but you don’t own the vehicle at the end of the lease term․

Navigating the Car Loan Application Process

Applying for a car loan can seem daunting, but understanding the process can make it less intimidating․

- Check Your Credit Score: Before applying, know your credit score to get an idea of the interest rates you might qualify for․

- Shop Around for Lenders: Don’t settle for the first offer you receive․ Compare rates from different banks, credit unions, and online lenders․

- Get Pre-Approved: Getting pre-approved gives you a better understanding of how much you can borrow and strengthens your negotiating position with the dealership․

- Review the Loan Terms Carefully: Pay attention to the interest rate, loan term, monthly payment, and any fees associated with the loan․

- Negotiate the Price of the Vehicle: Don’t just focus on the monthly payment․ Negotiate the overall price of the car to ensure you’re getting a fair deal․

The Impact of Loan Term on Your Car Loan

The loan term, or the length of time you have to repay the loan, significantly affects your monthly payments and the total amount of interest you pay․

Shorter Loan Terms

Shorter loan terms result in higher monthly payments but lower total interest paid over the life of the loan․ You’ll own the car sooner and save money in the long run․

Longer Loan Terms

Longer loan terms result in lower monthly payments, making the loan more affordable in the short term․ However, you’ll pay significantly more interest over the life of the loan․

Final Thoughts on Car Loans and Income

While income is a critical factor in car loan approval, it’s not the only one․ Lenders consider a range of factors, including your credit history, credit score, DTI, loan amount, and vehicle type․ By understanding these factors and taking steps to improve your creditworthiness, you can increase your chances of getting approved for a car loan with favorable terms․