In the ever-evolving landscape of digital finance‚ decentralized currencies are emerging as a powerful force‚ reshaping traditional financial systems and offering unprecedented opportunities for investors and entrepreneurs alike. These currencies‚ operating outside the control of central banks and governments‚ present a paradigm shift with inherent advantages that cater specifically to the needs of digital financiers. Understanding these benefits is crucial for navigating the future of finance and capitalizing on the potential of this groundbreaking technology. From enhanced security to increased efficiency‚ decentralized currencies are poised to revolutionize the way we transact and invest in the digital age.

Understanding Decentralized Currency

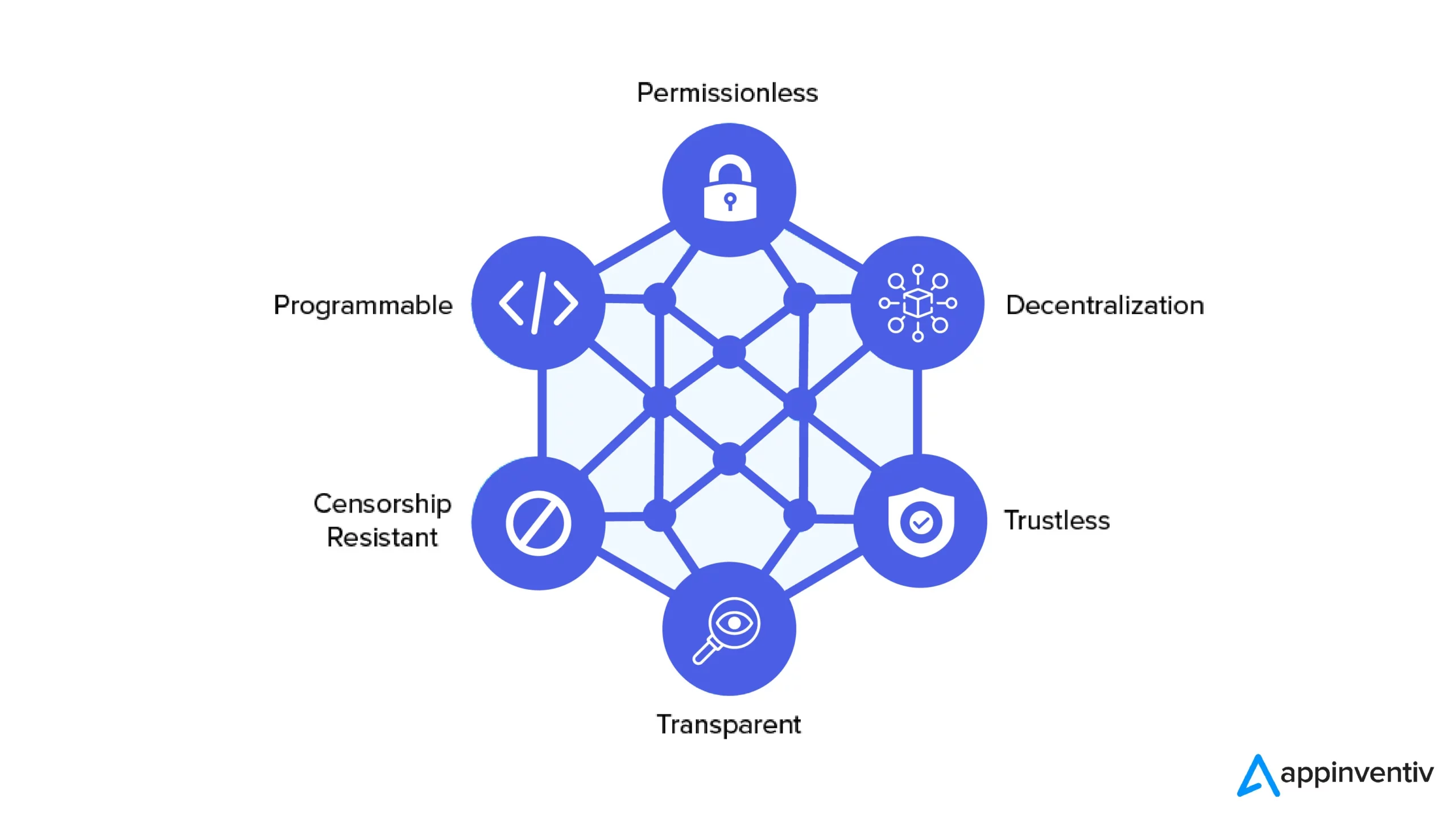

Decentralized currency‚ often associated with cryptocurrencies like Bitcoin and Ethereum‚ operates on a distributed ledger technology‚ typically a blockchain. This means that transactions are recorded across a network of computers‚ rather than being managed by a single central authority. This distributed nature offers several key advantages.

- Transparency: All transactions are publicly recorded on the blockchain‚ enhancing transparency and accountability.

- Security: The distributed nature of the blockchain makes it resistant to hacking and censorship.

- Accessibility: Decentralized currencies can be accessed by anyone with an internet connection‚ regardless of their location or financial status.

Key Advantages for Digital Financiers

Enhanced Security and Fraud Prevention

One of the most significant advantages of decentralized currency is its enhanced security. The cryptographic nature of blockchain technology makes it extremely difficult to tamper with transactions or create fraudulent entries. This provides a higher level of security compared to traditional financial systems‚ which are often vulnerable to hacking and fraud.

Reduced Transaction Costs and Faster Processing

Decentralized currencies eliminate the need for intermediaries such as banks and payment processors‚ which can significantly reduce transaction costs. Furthermore‚ transactions can be processed much faster than traditional bank transfers‚ often within minutes or even seconds.

Factoid: The average transaction fee for Bitcoin is significantly lower than the fees charged by traditional international wire transfers.

Increased Privacy and Anonymity

While not entirely anonymous‚ decentralized currencies offer a higher degree of privacy compared to traditional financial systems. Transactions are typically linked to pseudonymous addresses rather than personal identities‚ which can help protect users’ privacy.

Global Reach and Accessibility

Decentralized currencies are not tied to any specific country or region‚ making them ideal for international transactions. They can be accessed by anyone with an internet connection‚ regardless of their location or financial status‚ opening up new opportunities for global commerce and investment.

Potential for Higher Returns

The volatility of decentralized currencies can present both risks and opportunities for investors. While prices can fluctuate significantly‚ there is also the potential for substantial returns. Digital financiers can leverage their expertise to navigate the market and capitalize on these opportunities.

Potential Challenges and Considerations

Despite the numerous advantages‚ it’s important to acknowledge the potential challenges associated with decentralized currency:

- Volatility: The price of decentralized currencies can be highly volatile‚ making them a risky investment.

- Regulation: The regulatory landscape surrounding decentralized currencies is still evolving‚ which can create uncertainty.

- Scalability: Some decentralized currencies face scalability issues‚ which can limit their ability to handle a large volume of transactions.

FAQ: Decentralized Currency

What is a decentralized currency?

A decentralized currency is a digital or virtual currency that operates independently of a central bank or government. It relies on a distributed ledger technology‚ such as blockchain‚ to record and verify transactions.

How does decentralized currency work?

Decentralized currency works by using cryptography to secure transactions and control the creation of new units. Transactions are verified by a network of computers and recorded on a distributed ledger‚ making it difficult to tamper with the system.

What are the risks of investing in decentralized currency?

The risks of investing in decentralized currency include price volatility‚ regulatory uncertainty‚ and the potential for hacking or fraud. It’s important to do your research and understand the risks before investing.

How can I get started with decentralized currency?

You can get started with decentralized currency by creating a digital wallet‚ purchasing cryptocurrency on an exchange‚ and learning about the technology and market. It’s also a good idea to consult with a financial advisor before making any investment decisions.

What is the future of decentralized currency?

The future of decentralized currency is uncertain‚ but many experts believe that it has the potential to revolutionize the financial industry. As the technology matures and regulations become clearer‚ decentralized currencies may become more widely adopted.

The Role of Smart Contracts

Smart contracts‚ self-executing contracts written in code and stored on the blockchain‚ are playing an increasingly important role in the decentralized finance (DeFi) space. These contracts automate agreements and transactions‚ eliminating the need for intermediaries and further reducing costs and increasing efficiency. For digital financiers‚ smart contracts offer a powerful tool for creating innovative financial products and services.

Examples of DeFi Applications

The potential applications of DeFi are vast and continue to expand. Some examples include:

- Decentralized Exchanges (DEXs): Platforms that allow users to trade cryptocurrencies directly with each other‚ without the need for a central exchange.

- Lending and Borrowing Platforms: Platforms that allow users to lend and borrow cryptocurrencies‚ earning interest on their deposits or borrowing funds at competitive rates.

- Stablecoins: Cryptocurrencies designed to maintain a stable value‚ often pegged to a fiat currency like the US dollar.

- Yield Farming: A strategy where users earn rewards by providing liquidity to DeFi protocols.

Navigating the Decentralized Finance Landscape

Successfully navigating the decentralized finance landscape requires a combination of technical expertise‚ financial acumen‚ and a thorough understanding of the risks involved. Digital financiers need to stay informed about the latest developments in the space‚ understand the underlying technology‚ and carefully assess the risks and rewards of each investment opportunity.

Factoid: The total value locked (TVL) in DeFi protocols has grown exponentially in recent years‚ indicating the increasing adoption and popularity of decentralized finance.

The Future of Finance: A Decentralized Vision

Decentralized currency and decentralized finance are not just passing trends; they represent a fundamental shift in the way we think about and interact with money. As the technology matures and adoption grows‚ we can expect to see even more innovative applications emerge‚ further blurring the lines between traditional finance and the decentralized world. For digital financiers‚ embracing this decentralized vision is crucial for staying ahead of the curve and capitalizing on the opportunities that lie ahead.

Essential Skills for Digital Financiers in the Decentralized Era

To thrive in the decentralized finance landscape‚ digital financiers need to develop a specific set of skills:

- Blockchain Technology Understanding: A solid grasp of blockchain technology‚ including its underlying principles and limitations.

- Smart Contract Development: Proficiency in programming languages used for smart contract development‚ such as Solidity.

- DeFi Protocol Knowledge: Familiarity with various DeFi protocols and their functionalities.

- Risk Management: Ability to assess and manage the risks associated with DeFi investments.

- Financial Modeling: Skills in financial modeling and analysis to evaluate the potential returns of DeFi projects.

Decentralized currency offers a compelling alternative to traditional financial systems‚ providing digital financiers with enhanced security‚ reduced transaction costs‚ increased privacy‚ and global accessibility. While challenges and risks remain‚ the potential rewards are significant. By embracing the decentralized revolution and developing the necessary skills‚ digital financiers can position themselves for success in the future of finance.

Further Resources

To continue learning about decentralized currency and decentralized finance‚ consider exploring the following resources:

- Online courses and tutorials on blockchain technology and cryptocurrency.

- Industry publications and blogs covering DeFi developments.

- DeFi communities and forums for networking and knowledge sharing.