For Irish investors navigating the complex world of finance‚ choosing the right company to invest in requires careful consideration of several factors. The Irish economy‚ while robust‚ presents unique opportunities and challenges that demand a tailored investment approach. Understanding your risk tolerance‚ investment goals‚ and the specific sectors poised for growth in Ireland is crucial before committing capital. Therefore‚ the question of what company should Irish investing in is not a simple one‚ but rather a journey of research and strategic decision-making.

Understanding the Irish Investment Landscape

The Irish investment landscape is characterized by a mix of established industries and emerging sectors. Technology‚ pharmaceuticals‚ and financial services are key pillars of the economy‚ while renewable energy and sustainable agriculture are gaining momentum. Investors should consider these trends when evaluating potential investment opportunities.

Key Sectors to Watch:

- Technology: Ireland is a hub for tech giants‚ but also boasts a thriving startup scene.

- Pharmaceuticals: A strong presence of multinational pharmaceutical companies provides stability.

- Financial Services: Dublin is a major financial center‚ offering opportunities in banking‚ insurance‚ and asset management.

- Renewable Energy: Government initiatives and growing environmental awareness are driving growth in this sector.

- Sustainable Agriculture: Ireland’s agricultural heritage is being modernized with sustainable practices.

Factors to Consider Before Investing

Before making any investment decisions‚ Irish investors should carefully assess their own financial situation and investment goals. This includes understanding their risk tolerance‚ time horizon‚ and desired return on investment. Diversification is also crucial to mitigate risk.

Important Questions to Ask Yourself:

- What is my risk tolerance? Am I comfortable with high-risk‚ high-reward investments‚ or do I prefer a more conservative approach?

- What are my investment goals? Am I saving for retirement‚ a down payment on a house‚ or another specific goal?

- What is my time horizon? How long do I plan to hold the investment?

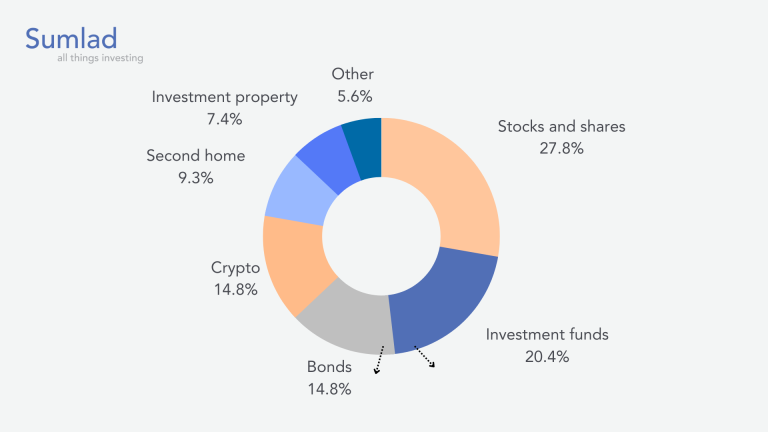

- How diversified is my portfolio? Am I putting all my eggs in one basket‚ or am I spreading my investments across different sectors and asset classes?

Remember to conduct thorough due diligence on any company you are considering investing in. This includes reviewing their financial statements‚ understanding their business model‚ and assessing their competitive landscape. Seeking advice from a qualified financial advisor is also recommended. Considering these factors will help you determine what company should Irish investing in.

FAQ: Investing in Ireland

Here are some frequently asked questions about investing in Ireland:

- Q: What are the tax implications of investing in Ireland?

A: Investment income is generally subject to income tax in Ireland. The specific tax rate will depend on your individual circumstances. - Q: How can I find a qualified financial advisor in Ireland?

A: You can find a qualified financial advisor through the Central Bank of Ireland’s website or by searching online directories. - Q: What are the risks of investing in the stock market?

A: The stock market is inherently risky‚ and you could lose money on your investments. It is important to understand the risks involved before investing.

Comparative Table: Investment Options in Ireland

| Investment Type | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Moderate | Moderate | Moderate |

| Real Estate | Moderate | Moderate | Low |

| Savings Accounts | Low | Low | High |

Ultimately‚ the decision of what company to invest in is a personal one. However‚ by carefully considering the factors outlined above‚ Irish investors can make informed decisions that align with their financial goals; Therefore‚ when considering what company should Irish investing in‚ remember to do your research and seek professional advice.

Emerging Trends and Future Opportunities

Looking ahead‚ several emerging trends are shaping the future of investment in Ireland. The increasing focus on sustainability and environmental‚ social‚ and governance (ESG) factors is driving demand for investments in renewable energy‚ green technology‚ and socially responsible businesses. Furthermore‚ the growth of the digital economy is creating opportunities in areas such as e-commerce‚ fintech‚ and cybersecurity.

Areas of Potential Growth:

- ESG Investing: Companies with strong ESG credentials are attracting increasing investor interest.

- Fintech: Ireland’s thriving fintech sector is ripe with innovative startups.

- Cybersecurity: As businesses become increasingly reliant on technology‚ the demand for cybersecurity solutions is growing.

- Artificial Intelligence (AI): AI is transforming various industries‚ creating opportunities for investment in AI-powered solutions.

- Biotechnology: Ireland’s strong pharmaceutical sector provides a foundation for growth in biotechnology.

Navigating Market Volatility

The global economy is currently facing a period of uncertainty‚ with rising inflation‚ interest rate hikes‚ and geopolitical tensions impacting financial markets. Irish investors need to be prepared for market volatility and have a strategy in place to manage risk. This may involve diversifying their portfolio‚ rebalancing their investments‚ and staying informed about market developments.

Strategies for Managing Volatility:

- Diversification: Spreading investments across different asset classes and sectors can help to reduce risk.

- Rebalancing: Periodically rebalancing your portfolio to maintain your desired asset allocation.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals‚ regardless of market conditions.

- Staying Informed: Keeping up-to-date with market news and economic developments.

- Seeking Professional Advice: Consulting with a financial advisor to develop a personalized investment strategy.

The Role of Government Policy

Government policy plays a significant role in shaping the investment landscape in Ireland. Tax incentives‚ grants‚ and other support measures can encourage investment in specific sectors and regions. Investors should be aware of these policies and how they may impact their investment decisions. For example‚ government initiatives aimed at promoting renewable energy could create opportunities for investment in wind farms‚ solar power plants‚ and other renewable energy projects.

Final Thoughts

Choosing the right investment requires careful consideration of individual circumstances‚ market conditions‚ and emerging trends. By conducting thorough research‚ seeking professional advice‚ and staying informed about the Irish economy‚ investors can make informed decisions that align with their financial goals. Remember‚ the best investment is one that is well-suited to your individual needs and risk tolerance. Therefore‚ when considering what company should Irish investing in‚ remember to consider all the factors discussed and make a well-informed decision.

Understanding Investment Risks

Investing always involves risk‚ and it’s crucial to understand the different types of risks associated with various investment options. Some common risks include market risk (the risk of losing money due to market fluctuations)‚ credit risk (the risk that a borrower will default on their debt)‚ and liquidity risk (the risk of not being able to sell an investment quickly enough to prevent a loss). Understanding these risks can help Irish investors make more informed decisions and manage their portfolios effectively.

Types of Investment Risks:

- Market Risk: The risk that the value of an investment will decline due to changes in market conditions‚ such as economic downturns‚ interest rate hikes‚ or geopolitical events.

- Credit Risk: The risk that a borrower will default on their debt obligations‚ resulting in a loss for the investor.

- Liquidity Risk: The risk that an investment cannot be sold quickly enough to prevent a loss‚ especially in times of market stress.

- Inflation Risk: The risk that the rate of inflation will outpace the return on an investment‚ reducing its real value.

- Currency Risk: The risk that changes in exchange rates will negatively impact the value of an investment denominated in a foreign currency.

The Importance of Financial Planning

Before making any investment decisions‚ it’s essential to have a solid financial plan in place. A financial plan should outline your financial goals‚ risk tolerance‚ time horizon‚ and investment strategy. It should also include a budget‚ a savings plan‚ and a debt management strategy. A well-crafted financial plan can help Irish investors stay on track to achieve their financial goals and make informed investment decisions.

Key Components of a Financial Plan:

- Financial Goals: Clearly defined goals‚ such as retirement planning‚ buying a home‚ or funding education.

- Risk Tolerance: An assessment of your comfort level with risk‚ which will influence your investment choices.

- Time Horizon: The length of time you plan to hold your investments‚ which will impact your investment strategy.

- Investment Strategy: A plan for how you will allocate your assets across different investment options.

- Budget: A plan for managing your income and expenses.

- Savings Plan: A plan for saving money regularly.

- Debt Management Strategy: A plan for managing and paying off debt.

Leveraging Technology for Investment

Technology has revolutionized the investment landscape‚ providing Irish investors with access to a wide range of tools and resources. Online brokerage platforms‚ robo-advisors‚ and financial planning apps can help investors research investment options‚ manage their portfolios‚ and track their progress towards their financial goals. However‚ it’s important to use these tools wisely and to be aware of the potential risks associated with online investing.

Technological Tools for Investors:

- Online Brokerage Platforms: Platforms that allow investors to buy and sell stocks‚ bonds‚ and other investments online.

- Robo-Advisors: Automated investment platforms that provide personalized investment advice and portfolio management services.

- Financial Planning Apps: Apps that help investors track their finances‚ set financial goals‚ and create budgets.

- Investment Research Tools: Online resources that provide information and analysis on various investment options.

- Trading Platforms: Software applications used for executing trades in financial markets.

Staying Informed and Seeking Professional Advice

The investment landscape is constantly evolving‚ so it’s important for Irish investors to stay informed about market trends‚ economic developments‚ and regulatory changes. Reading financial news‚ attending investment seminars‚ and consulting with a qualified financial advisor can help investors stay up-to-date and make informed decisions. Remember‚ seeking professional advice is particularly important if you are new to investing or if you have complex financial needs.

Resources for Staying Informed:

- Financial News Websites: Websites that provide up-to-date news and analysis on financial markets and the economy.

- Investment Seminars: Educational events that provide information on various investment topics.

- Financial Advisors: Professionals who provide personalized financial advice and investment management services.

- Regulatory Agencies: Government agencies that regulate the financial industry and provide information to investors.

- Industry Associations: Organizations that represent financial professionals and provide resources for investors.