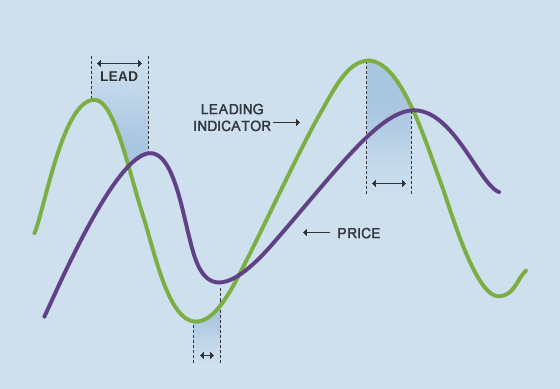

Navigating the complexities of the Forex market requires a keen understanding of various analytical tools. Among these, leading indicators play a crucial role in anticipating future price movements. These indicators, unlike lagging indicators that confirm trends after they’ve begun, aim to provide early signals of potential shifts in market sentiment and direction. Understanding what are the leading indicators in Forex is essential for traders seeking to capitalize on emerging opportunities and mitigate risks before they fully materialize. By carefully analyzing these signals, traders can make more informed decisions about when to enter or exit positions, ultimately improving their profitability.

Understanding Leading Indicators

Leading indicators, also sometimes referred to as predictive indicators, are designed to precede price action. They attempt to forecast future market movements by analyzing various economic and market data. These indicators are not foolproof, and their signals should always be considered in conjunction with other forms of analysis, such as technical and fundamental analysis. However, they can offer valuable insights into potential turning points and trend reversals.

Common Types of Leading Indicators

- Economic Data Releases: Certain economic reports, such as Purchasing Managers’ Index (PMI), Consumer Confidence Index, and housing starts, can provide clues about the future health of an economy and its currency. Strong economic data often leads to currency appreciation, while weak data can signal potential depreciation.

- Interest Rate Differentials: The difference in interest rates between two countries can be a leading indicator of currency movements. Higher interest rates tend to attract foreign investment, increasing demand for the currency and potentially leading to appreciation.

- Commodity Prices: For commodity-dependent economies, changes in commodity prices can be a leading indicator of currency value. For example, a rise in oil prices might benefit the Canadian dollar.

- Sentiment Indicators: These indicators gauge the overall mood or attitude of investors towards a particular currency or market. Examples include the Commitment of Traders (COT) report, which shows the positioning of various market participants.

Using Leading Indicators Effectively

While leading indicators can be valuable tools, it’s crucial to use them with caution and in conjunction with other forms of analysis. No single indicator is always accurate, and relying solely on leading indicators can lead to false signals and losses.

Here are some tips for using leading indicators effectively:

- Confirm signals with other indicators: Don’t rely solely on one leading indicator. Look for confirmation from other technical or fundamental indicators.

- Consider the overall market context: Leading indicators should be interpreted within the context of the broader market environment.

- Manage risk: Always use stop-loss orders to limit potential losses.

- Backtest your strategies: Before implementing a strategy based on leading indicators, backtest it on historical data to assess its effectiveness.

FAQ: Leading Indicators in Forex

- Q: Are leading indicators always accurate?

- A: No, leading indicators are not always accurate. They provide potential signals, but should be used in conjunction with other forms of analysis.

- Q: What is the difference between leading and lagging indicators?

- A: Leading indicators attempt to predict future price movements, while lagging indicators confirm trends that have already begun.

- Q: Can I rely solely on leading indicators for trading decisions?

- A: No, it’s not recommended to rely solely on leading indicators. Always use them in conjunction with other forms of analysis and risk management techniques.