The Forex market, renowned for its 24/5 operation, presents traders with opportunities around the clock. However, the beginning of the week, specifically Monday, often exhibits distinct characteristics that can significantly impact trading strategies. Understanding these nuances is crucial for both novice and experienced traders aiming to optimize their performance and mitigate potential risks. Therefore, exploring the unique dynamics of Monday trading is essential for informed decision-making in the Forex market;

Monday trading in the Forex market often differs significantly from the rest of the week. Several factors contribute to this phenomenon, including:

- Weekend Gaps: News and events occurring over the weekend can create gaps in price when the market opens on Monday. These gaps can lead to unexpected volatility and potential losses if not managed carefully.

- Reduced Liquidity: Liquidity tends to be lower on Monday mornings, especially in the early hours, as major financial centers gradually resume operations. This can result in wider spreads and increased slippage.

- Delayed Reaction to News: The market might take time to fully digest and react to weekend news events, leading to erratic price movements.

The Impact of Weekend News and Events

The Forex market operates continuously, but most traders take a break over the weekend. During this time, significant economic, political, or social events can occur that impact currency values. When the market reopens on Monday, these events can cause significant price fluctuations and create uncertainty for traders.

Factoid: Historically, Mondays have shown a higher incidence of gap openings in Forex pairs compared to other weekdays. These gaps are often attributed to the accumulation of news and market sentiment over the weekend.

Potential Risks of Trading Forex on Mondays

Trading Forex on Mondays presents several potential risks that traders should be aware of:

- Increased Volatility: The combination of weekend gaps and delayed reactions to news can lead to higher volatility, making it difficult to predict price movements accurately.

- Wider Spreads: Lower liquidity can result in wider spreads, increasing the cost of trading and reducing potential profits.

- False Breakouts: The erratic price movements on Mondays can sometimes lead to false breakouts, trapping traders in losing positions.

It’s important to note that not all Mondays are the same. The specific characteristics of a Monday trading session can vary depending on the time of year, the economic calendar, and global events.

Strategies for Trading Forex on Mondays (If You Choose To)

If you decide to trade Forex on Mondays, it’s crucial to adopt a cautious and well-informed approach:

- Analyze Weekend News: Thoroughly review any significant news or events that occurred over the weekend and assess their potential impact on currency values.

- Use Wider Stop-Losses: Account for the increased volatility by using wider stop-loss orders to protect your capital from unexpected price swings.

- Trade with Smaller Position Sizes: Reduce your risk exposure by trading with smaller position sizes.

- Consider Waiting for Confirmation: Wait for the market to settle down and establish a clear trend before entering any trades;

Alternative Approaches: Avoiding Monday Trading

Given the potential risks associated with Monday trading, some traders choose to avoid it altogether. This approach allows them to sidestep the increased volatility and uncertainty, focusing instead on trading during more stable periods of the week.

FAQ: Trading Forex on Mondays

Is it always a bad idea to trade Forex on Mondays?

Not necessarily. While Mondays can be more volatile, some traders thrive on that volatility. It depends on your trading style and risk tolerance.

What time of day is best to trade Forex on Mondays?

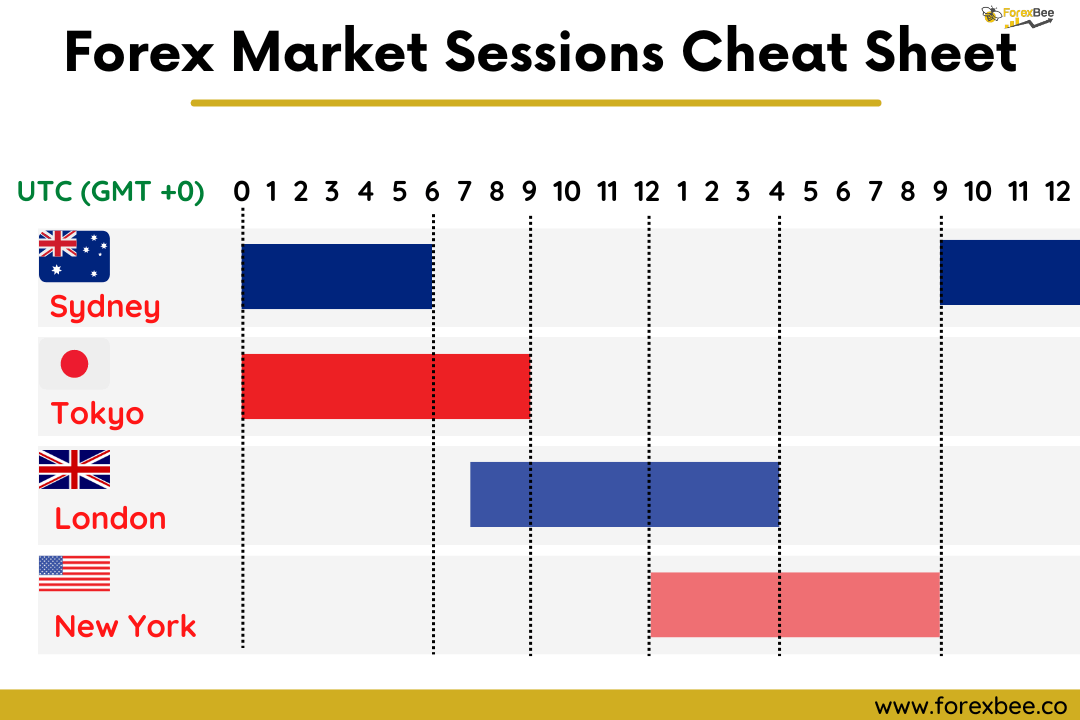

Generally, the market tends to stabilize later in the day as liquidity improves and the initial reactions to weekend news subside. Consider trading after the European and US market opens.

How can I prepare for Monday trading?

Stay informed about weekend news, analyze potential market impacts, and adjust your risk management accordingly.

Are there specific currency pairs that are more volatile on Mondays?

Pairs involving currencies from countries where significant economic or political events occurred over the weekend are often more volatile.

What are weekend gaps in Forex?

Weekend gaps are price differences between the closing price on Friday and the opening price on Monday. They are caused by events that occur when the market is closed.

Should I use a different strategy on Mondays?

Yes, adapting your strategy is crucial. Consider using wider stop-losses, smaller position sizes, and waiting for confirmation of trends before entering trades.

Trading Forex on Mondays presents a unique set of challenges and opportunities. While some traders may find the increased volatility appealing, others may prefer to avoid it altogether. The key is to understand the dynamics of Monday trading, assess your risk tolerance, and develop a strategy that aligns with your individual goals. Whether you choose to trade or abstain, making informed decisions is paramount to success in the Forex market.

Ultimately, the decision of whether or not to trade Forex on Mondays is a personal one. There’s no universal “right” answer. Carefully weigh the potential risks and rewards, and choose the approach that best suits your trading style and risk management preferences. Remember to continuously learn and adapt as the market evolves.

Trading Forex on Mondays presents a unique set of challenges and opportunities. While some traders may find the increased volatility appealing, others may prefer to avoid it altogether. The key is to understand the dynamics of Monday trading, assess your risk tolerance, and develop a strategy that aligns with your individual goals. Whether you choose to trade or abstain, making informed decisions is paramount to success in the Forex market.

Ultimately, the decision of whether or not to trade Forex on Mondays is a personal one. There’s no universal “right” answer. Carefully weigh the potential risks and rewards, and choose the approach that best suits your trading style and risk management preferences. Remember to continuously learn and adapt as the market evolves.

Advanced Considerations for Monday Forex Trading

Beyond the basic strategies, experienced traders often delve into more sophisticated techniques to navigate the complexities of Monday trading. These might include:

- Gap Trading Strategies: Identifying and capitalizing on gap formations, understanding the likelihood of gap fills, and implementing appropriate risk management.

- Correlation Analysis: Examining the correlations between different currency pairs and asset classes to identify potential trading opportunities or hedge against risks. For example, understanding how EUR/USD movement might correlate with GBP/USD or even the S&P 500.

- Volume Analysis: Monitoring trading volume to confirm price movements and identify potential reversals. A breakout on low volume might be less reliable than one on high volume.

The Psychology of Monday Trading

The human element plays a significant role in Forex trading, and Monday is no exception. Traders returning after the weekend can be influenced by a variety of factors, including:

- Recency Bias: Overemphasizing recent events (weekend news) and neglecting longer-term trends.

- Emotional Trading: Reacting impulsively to price movements based on fear or greed, rather than following a pre-defined strategy.

- Revenge Trading: Attempting to recoup losses from previous trades, often leading to even greater losses.

Being aware of these psychological biases is crucial for maintaining discipline and making rational trading decisions, especially during the volatile Monday sessions.

Factoid: Studies have shown that traders are more likely to make impulsive decisions on Mondays due to a combination of factors, including weekend stress and the desire to quickly profit from market movements.

Tools and Resources for Monday Forex Analysis

To effectively analyze the Forex market on Mondays, traders can utilize a variety of tools and resources, including:

- Economic Calendars: Tracking upcoming economic releases and events that could impact currency values.

- News Feeds: Staying informed about global news and political developments that could influence market sentiment.

- Technical Analysis Software: Using charting tools and indicators to identify potential trading opportunities and manage risk.

- Brokerage Platforms: Accessing real-time market data, executing trades, and monitoring account performance.

Risk Management is Paramount

Regardless of your trading strategy, effective risk management is essential for protecting your capital and achieving long-term success in the Forex market. This is particularly important on Mondays, given the increased volatility and uncertainty.

Beyond the “Don’t Trade on Mondays” Mantra

While the advice to avoid trading on Mondays can be sound for beginners or those with a low risk tolerance, it’s important to recognize that the Forex market is constantly evolving. Opportunities can arise on any day of the week, including Mondays. The key is to approach Monday trading with a well-defined strategy, a clear understanding of the risks involved, and the discipline to stick to your plan. By mastering the nuances of Monday market dynamics, traders can potentially unlock profitable opportunities and gain a competitive edge.