Navigating the complexities of the foreign exchange (forex) market can be daunting, especially for newcomers. One crucial aspect of successful forex trading is understanding how different currency pairs correlate with each other. These correlations can significantly impact your trading strategy, risk management, and overall profitability. By identifying and leveraging these relationships, traders can make more informed decisions and potentially reduce their exposure to unnecessary risk. This article will delve into the intricacies of forex pair correlations, providing you with the knowledge to enhance your trading skills.

What are Forex Pair Correlations?

Forex pair correlations refer to the statistical measure of how two currency pairs move in relation to each other. A positive correlation indicates that the pairs tend to move in the same direction, while a negative correlation suggests they move in opposite directions. The correlation coefficient ranges from -1 to +1, where +1 represents a perfect positive correlation, -1 represents a perfect negative correlation, and 0 indicates no correlation.

Positive Correlation

A positive correlation means that when one currency pair increases in value, the other pair is also likely to increase. For example, EUR/USD and GBP/USD often exhibit a positive correlation. This is because both pairs involve the US dollar, and both the Eurozone and the UK economies are often influenced by similar global factors.

Negative Correlation

A negative correlation signifies that when one currency pair rises in value, the other pair is likely to fall. For instance, USD/CHF and USD/CAD often have a negative correlation with EUR/USD and GBP/USD. This is because when the US dollar strengthens, the USD/CHF and USD/CAD pairs tend to rise, while EUR/USD and GBP/USD tend to fall.

Why are Forex Pair Correlations Important?

Understanding forex pair correlations is vital for several reasons:

- Risk Management: Knowing how pairs correlate helps you avoid overexposure to similar trades. Holding multiple positions in highly correlated pairs effectively increases your risk.

- Diversification: Trading negatively correlated pairs can help diversify your portfolio and reduce overall risk.

- Hedging: Correlations can be used to hedge existing positions. If you have a long position in one currency pair, you can take a short position in a positively correlated pair to offset potential losses.

- Confirmation: Correlations can confirm your trading signals. If you see a buy signal on one pair and a positively correlated pair is also showing bullish signs, it can strengthen your conviction.

Factors Influencing Forex Pair Correlations

Several factors can influence forex pair correlations, including:

- Economic News and Data: Economic releases, such as GDP figures, inflation rates, and employment data, can impact multiple currency pairs simultaneously.

- Central Bank Policies: Interest rate decisions, quantitative easing, and other monetary policies can affect currency values and correlations.

- Geopolitical Events: Political instability, trade wars, and other geopolitical events can influence currency movements and correlations.

- Market Sentiment: Overall market sentiment and risk appetite can drive correlations, especially during periods of high volatility.

Common Forex Pair Correlations

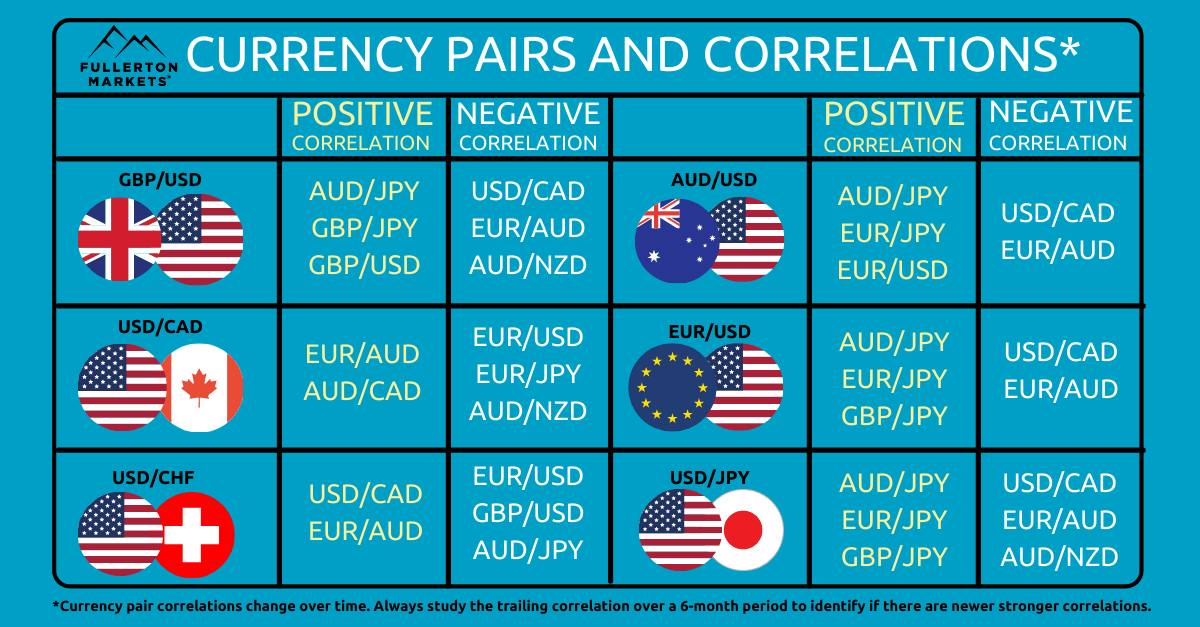

Here are some common forex pair correlations to be aware of:

- Positive Correlation: EUR/USD and GBP/USD, AUD/USD and NZD/USD, USD/JPY and USD/CHF.

- Negative Correlation: EUR/USD and USD/CHF, GBP/USD and USD/CHF, AUD/USD and USD/CAD.

How to Use Correlation in Trading

You can use correlation in trading in several ways:

- Avoid Overlapping Positions: Be mindful of holding multiple positions in highly correlated pairs.

- Diversify Your Portfolio: Include negatively correlated pairs in your portfolio to reduce risk.

- Confirm Trading Signals: Use correlations to confirm your trading signals and increase your confidence in your trades.

- Hedge Existing Positions: Use correlations to hedge your positions and protect against potential losses.

Factoid: Many online platforms and trading software offer correlation matrices, which visually display the correlation coefficients between different currency pairs. These matrices can be valuable tools for identifying and analyzing correlations.

FAQ Section

Q: How often should I check forex pair correlations?

A: It’s recommended to check correlations regularly, at least weekly, as they can change over time. Market conditions and economic factors can influence these relationships.

Q: Are correlations always reliable?

A: No, correlations are not always reliable. They are statistical measures based on historical data and can change. Use them as a guide, but always consider other factors and conduct thorough analysis.

Q: Can I use correlations for all trading strategies?

A: Correlations can be useful for various trading strategies, but they are not a one-size-fits-all solution. Consider your specific strategy and risk tolerance when incorporating correlations into your trading plan.

Q: Where can I find correlation data?

A: Many online platforms, trading software, and financial websites provide correlation matrices and data. You can also calculate correlations using historical price data.

Q: What is the difference between correlation and causation?

A: Correlation does not imply causation. Just because two currency pairs move together does not mean that one is causing the other to move. There may be other underlying factors influencing both pairs.