Navigating the complex world of Forex trading requires a keen understanding of various technical and fundamental analysis tools. One such powerful concept is confluence‚ a strategy that significantly enhances trading accuracy and confidence. It involves identifying multiple indicators or patterns that align and point towards the same trading direction. By combining different analysis methods‚ traders can filter out false signals and increase the probability of successful trades. Understanding confluence is crucial for any trader aiming to make informed decisions and improve their overall trading performance.

Understanding Confluence in Forex

Confluence in Forex trading refers to the convergence of multiple technical indicators‚ chart patterns‚ or fundamental factors that all suggest the same trading opportunity. It’s about finding areas on a chart where different analysis techniques agree‚ strengthening the validity of a potential trade. Instead of relying on a single indicator‚ confluence provides a more robust and reliable signal.

Key Elements of Confluence

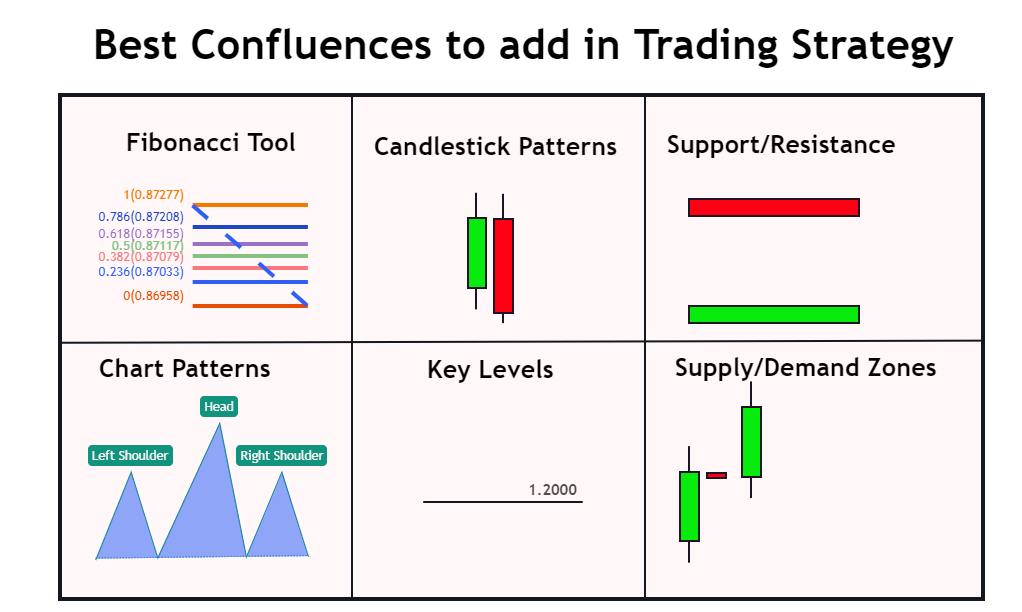

Technical Indicators: Moving averages‚ RSI‚ MACD‚ Fibonacci retracements‚ and other indicators can be used to identify potential entry and exit points.

Chart Patterns: Head and shoulders‚ double tops/bottoms‚ triangles‚ and other patterns can signal potential trend reversals or continuations.

Fundamental Analysis: Economic news releases‚ interest rate decisions‚ and geopolitical events can influence currency values.

Price Action: Analyzing candlestick patterns and price movements to identify support and resistance levels‚ as well as potential breakouts.

Benefits of Using Confluence

Using confluence offers several advantages to Forex traders:

Increased Accuracy: By combining multiple signals‚ traders can reduce the risk of false signals and improve the accuracy of their trades.

Higher Confidence: Knowing that multiple factors support a trade can increase a trader’s confidence and discipline.

Improved Risk Management: Confluence can help traders identify more precise entry and exit points‚ allowing for better risk management.

Enhanced Trading Strategy: Incorporating confluence into a trading strategy can make it more robust and adaptable to different market conditions.

Example of Confluence in Action

Imagine a scenario where the price of EUR/USD is approaching a key resistance level. At the same time‚ the RSI indicator is showing overbought conditions‚ and a bearish engulfing candlestick pattern is forming. Furthermore‚ a Fibonacci retracement level coincides with the resistance. This convergence of resistance‚ overbought RSI‚ bearish candlestick pattern‚ and Fibonacci level creates a strong confluence zone‚ suggesting a high probability of a price reversal.

FAQ about Confluence in Forex Trading

Q: How many indicators should I use for confluence?

A: There’s no magic number‚ but generally‚ 2-4 confirming signals are sufficient. Focus on quality over quantity.

Q: Is confluence a foolproof strategy?

A: No strategy is foolproof. Confluence increases the probability of success‚ but risk management is still crucial.

Q: Can I use confluence with any trading style?

A: Yes‚ confluence can be adapted to various trading styles‚ including day trading‚ swing trading‚ and position trading.

Q: Where can I learn more about confluence?

A: Online resources‚ trading courses‚ and experienced mentors can provide further insights into using confluence effectively.

Building Your Confluence Trading Strategy

Developing a successful confluence trading strategy requires a systematic approach. Here’s a step-by-step guide to help you get started:

- Identify Key Indicators: Choose a set of technical indicators that you are comfortable with and understand well. Common choices include moving averages‚ RSI‚ MACD‚ Fibonacci levels‚ and trendlines.

- Define Chart Patterns: Learn to recognize common chart patterns‚ such as head and shoulders‚ double tops/bottoms‚ triangles‚ and flags. These patterns can provide valuable insights into potential price movements.

- Incorporate Fundamental Analysis: Stay informed about economic news releases‚ interest rate decisions‚ and geopolitical events that can impact currency values. Use this information to confirm or reject potential trading signals.

- Establish Confluence Rules: Define specific rules for when you will consider a trade based on confluence. For example‚ you might require at least three confirming signals before entering a trade.

- Backtest Your Strategy: Test your confluence strategy on historical data to evaluate its performance and identify any weaknesses. This will help you refine your rules and improve your overall trading results.

- Practice Risk Management: Always use stop-loss orders to limit your potential losses and manage your risk effectively. Adjust your position size based on your risk tolerance and the volatility of the market.

Common Mistakes to Avoid

Overcomplicating Your Strategy: Don’t try to incorporate too many indicators or patterns. Keep your strategy simple and focused.

Ignoring Fundamental Analysis: Fundamental factors can significantly impact currency values‚ so don’t neglect them.

Chasing Trades: Don’t force trades that don’t meet your confluence criteria. Be patient and wait for the right opportunities.

Failing to Adapt: Market conditions can change over time‚ so be prepared to adjust your strategy as needed.

Advanced Confluence Techniques

Beyond the basics‚ there are more advanced techniques you can use to enhance your confluence trading strategy:

Multi-Timeframe Analysis: Analyze price action and indicators on multiple timeframes to identify potential trading opportunities. For example‚ you might look for confluence on the daily and hourly charts.

Correlation Analysis: Consider the correlation between different currency pairs and commodities. This can help you identify potential hedging opportunities or confirm trading signals.

Volume Analysis: Analyze trading volume to confirm the strength of price movements and identify potential breakouts or reversals.

By continuously learning and refining your approach‚ you can become a more skilled and profitable Forex trader. Remember that consistent practice and disciplined risk management are essential for long-term success. The effective use of confluence‚ combined with a solid trading plan‚ can significantly improve your odds in the Forex market.

The Psychology of Confluence Trading

Trading psychology plays a crucial role in the successful application of confluence. Even with a well-defined strategy‚ emotional biases can lead to poor decision-making. Here are some psychological aspects to consider:

- Confirmation Bias: The tendency to seek out information that confirms existing beliefs. Be aware of this bias and actively look for evidence that contradicts your trading idea.

- Fear of Missing Out (FOMO): The anxiety of missing a potentially profitable trade. Avoid chasing trades that don’t meet your confluence criteria.

- Overconfidence: The belief that you are more skilled than you actually are. Stay humble and continuously evaluate your performance.

- Loss Aversion: The tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain. Manage your risk effectively to avoid emotional decision-making.

Developing a Disciplined Mindset

Cultivating a disciplined mindset is essential for overcoming these psychological challenges. Here are some tips:

- Stick to Your Trading Plan: Follow your pre-defined rules and avoid deviating from your strategy based on emotions.

- Manage Your Emotions: Practice mindfulness and develop techniques for managing stress and anxiety.

- Accept Losses: Losses are a part of trading. Accept them as learning opportunities and move on.

- Celebrate Successes: Acknowledge and celebrate your wins to build confidence and motivation.

Tools and Resources for Confluence Trading

Several tools and resources can help you identify and analyze confluence in Forex trading:

- Trading Platforms: MetaTrader 4/5‚ TradingView‚ and other platforms offer a wide range of technical indicators and charting tools.

- Economic Calendars: Forex Factory‚ DailyFX‚ and other websites provide economic news releases and event schedules.

- Forex News Websites: Reuters‚ Bloomberg‚ and other news sources provide up-to-date market information and analysis.

- Trading Communities: Online forums and social media groups can provide valuable insights and support from other traders.

Leveraging Technology for Efficiency

Technology can significantly enhance your ability to identify and analyze confluence. Consider using:

- Automated Chart Pattern Recognition Software: These tools can automatically identify chart patterns and alert you to potential trading opportunities.

- Custom Indicators: Develop or use custom indicators that combine multiple signals into a single indicator for easier analysis.

- Trading Robots (EAs): Automate your trading strategy using expert advisors (EAs) that execute trades based on your confluence rules.

Ultimately‚ the best approach to confluence trading is one that aligns with your individual trading style‚ risk tolerance‚ and personality. Experiment with different techniques‚ tools‚ and resources to find what works best for you. Remember that continuous learning and adaptation are key to long-term success in the Forex market. The power of confluence lies in its ability to provide a more comprehensive and reliable view of the market‚ leading to more informed and profitable trading decisions. Therefore‚ understanding and applying the principles of confluence is a valuable skill for any Forex trader seeking to improve their trading performance.