Tick volume, a seemingly simple metric, holds valuable insights for Forex traders. Unlike traditional volume in stock markets, Forex volume represents the number of price changes (ticks) occurring within a specific timeframe. Understanding how to interpret and utilize tick volume can significantly enhance your trading strategies and improve your ability to identify potential market movements. This guide will explore the nuances of tick volume, providing practical tips and techniques for incorporating it into your Forex trading toolkit. Mastering this indicator can offer a distinct advantage in navigating the complexities of the currency markets.

What is Tick Volume?

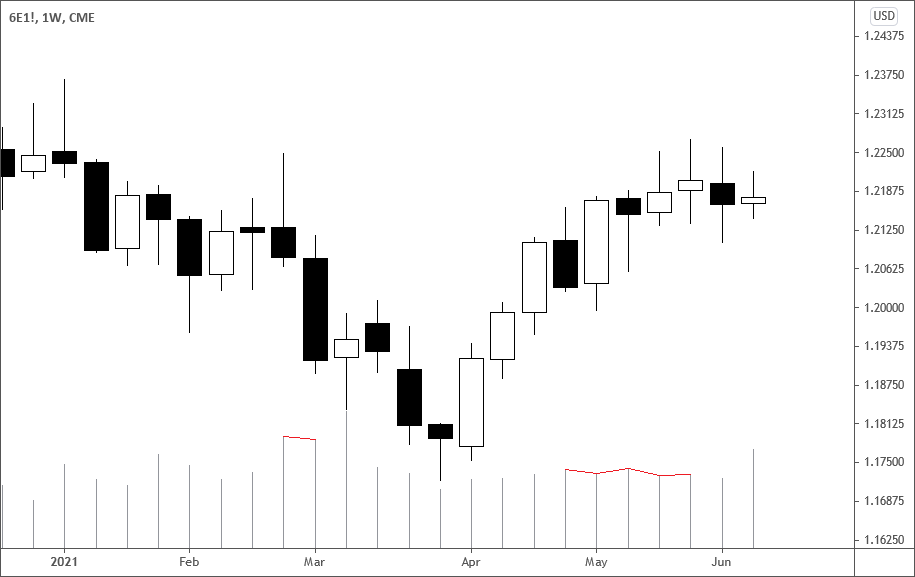

In Forex trading, true volume, reflecting the actual number of currency units traded, is unavailable due to the decentralized nature of the market. Tick volume serves as a proxy, representing the number of price changes (ticks) that occur within a given period. A higher tick volume generally indicates greater market activity and potentially stronger price movements, while lower tick volume suggests reduced activity and potentially sideways price action.

Why Use Tick Volume?

- Confirmation of Price Movements: Tick volume can help confirm the strength of a price trend. A rising price accompanied by increasing tick volume suggests strong buying pressure.

- Identification of Potential Reversals: Divergences between price and tick volume can signal potential trend reversals. For example, if the price is making new highs but tick volume is declining, it could indicate weakening momentum.

- Assessment of Market Liquidity: Higher tick volume generally indicates greater liquidity, allowing for easier order execution.

- Improved Entry and Exit Points: By analyzing tick volume, traders can identify more opportune times to enter and exit trades.

How to Interpret Tick Volume

Interpreting tick volume effectively requires understanding its relationship with price action. Here are some key considerations:

- Volume Confirmation: Look for tick volume to confirm price movements. A price breakout accompanied by a surge in tick volume is more likely to be sustained than a breakout with low tick volume.

- Divergence Analysis: Pay attention to divergences between price and tick volume. A bearish divergence (price making higher highs while tick volume makes lower highs) can signal a potential downtrend.

- Volume Spikes: Significant spikes in tick volume often indicate important events or changes in market sentiment.

Factoid: Tick volume is most effective when used in conjunction with other technical indicators, such as moving averages, oscillators, and price action patterns.

Using Tick Volume with Other Indicators

Tick volume is most powerful when combined with other technical analysis tools. Some common combinations include:

- Moving Averages: Use tick volume to confirm breakouts above or below moving averages.

- RSI (Relative Strength Index): Look for divergences between price and RSI, and then use tick volume to confirm the potential reversal.

- MACD (Moving Average Convergence Divergence): Combine MACD signals with tick volume to filter out false signals.

Practical Tips for Using Tick Volume

- Choose the Right Timeframe: Experiment with different timeframes to find the one that best suits your trading style and the currency pair you are trading.

- Compare Volume to Recent History: Assess current tick volume in relation to its recent historical levels to determine whether it is high or low.

- Be Aware of News Events: Major news events can cause significant spikes in tick volume, which may temporarily distort the market.

Factoid: Tick volume can be particularly useful for scalping and day trading strategies, as it provides insights into short-term price movements.

FAQ: Tick Volume in Forex

Q: Is tick volume the same as real volume?

A: No, tick volume is a proxy for real volume in Forex, representing the number of price changes (ticks) rather than the actual number of currency units traded.

Q: Can I use tick volume on all Forex pairs?

A: Yes, tick volume can be used on any Forex pair, but its effectiveness may vary depending on the pair’s liquidity and volatility.

Q: What is considered high tick volume?

A: High tick volume is relative and depends on the specific currency pair and timeframe. Compare current tick volume to its recent historical levels to determine what constitutes high volume for that particular market.

Q: Is tick volume a lagging or leading indicator?

A: Tick volume is generally considered a coincident indicator, meaning it reflects current market activity. However, analyzing divergences between price and tick volume can provide potential leading signals.

Q: Where can I find tick volume data?

A: Most Forex trading platforms provide tick volume data as part of their charting packages.

Advanced Tick Volume Strategies

Beyond the basics, several advanced strategies leverage tick volume for more sophisticated trading decisions. These strategies require a deeper understanding of market dynamics and risk management.

Volume Spread Analysis (VSA) with Tick Volume

VSA focuses on the relationship between price, volume, and the closing price of a bar or candlestick. While traditionally used with real volume, adapting VSA principles to tick volume can provide valuable insights into supply and demand dynamics in the Forex market.

- Effort vs. Result: Analyze whether the effort (tick volume) is matching the result (price movement). High tick volume with little price movement might indicate absorption of supply or demand.

- Upthrusts and Springs: Look for upthrusts (false breakouts) and springs (false breakdowns) accompanied by specific tick volume patterns to identify potential reversals.

Tick Volume and Order Flow

While tick volume doesn’t directly reveal order flow, it can provide clues about the intensity of buying and selling pressure. Analyzing tick volume in conjunction with price action can help traders infer the underlying order flow dynamics.

- Aggressive Buying/Selling: A sudden surge in tick volume accompanying a strong price movement suggests aggressive buying or selling.

- Absorption: High tick volume with limited price movement could indicate absorption of orders by larger players.

Common Mistakes to Avoid

While tick volume can be a valuable tool, it’s crucial to avoid common mistakes that can lead to misinterpretations and poor trading decisions.

- Ignoring Context: Don’t analyze tick volume in isolation. Always consider the broader market context, including trend direction, support and resistance levels, and news events.

- Over-Reliance: Tick volume should not be the sole basis for trading decisions. Use it in conjunction with other technical indicators and risk management principles.

- Assuming Causation: Remember that correlation does not equal causation. Just because tick volume increases before a price movement doesn’t necessarily mean it caused the movement.

Tick volume is a valuable tool for Forex traders, providing insights into market activity and potential price movements. By understanding how to interpret tick volume and incorporate it into your trading strategies, you can enhance your ability to identify profitable trading opportunities. Remember to use tick volume in conjunction with other technical indicators, risk management principles, and a thorough understanding of market dynamics. Continuous learning and practice are essential for mastering the art of trading with tick volume and achieving consistent success in the Forex market. The key is consistent application and adapting your strategies to the ever-changing market conditions.