Navigating the world of financial markets can be overwhelming‚ especially when trying to understand the nuances of different trading instruments․ Two popular avenues for potential profit are options trading and forex trading․ While both offer opportunities for financial gain‚ they operate in distinct markets‚ involve different underlying assets‚ and require unique strategies․ This article will delve into the key differences between options trading and forex trading‚ providing a clear understanding of each and helping you determine which might be a better fit for your investment goals and risk tolerance․ Understanding these differences is crucial for making informed decisions and increasing your chances of success in the financial markets․

What is Options Trading?

Options trading involves contracts that give the buyer the right‚ but not the obligation‚ to buy or sell an underlying asset at a specific price (the strike price) on or before a specific date (the expiration date)․ These underlying assets can include stocks‚ ETFs‚ commodities‚ or even currencies․ There are two main types of options: call options (the right to buy) and put options (the right to sell)․

- Call Option: Gives the holder the right to buy the underlying asset at the strike price․

- Put Option: Gives the holder the right to sell the underlying asset at the strike price․

Key Characteristics of Options Trading

- Leverage: Options offer leverage‚ allowing traders to control a large number of shares with a relatively small investment․

- Defined Risk: Buyers of options know their maximum potential loss is the premium paid for the option․

- Expiration Date: Options have a limited lifespan‚ expiring on a specific date․

- Flexibility: Options strategies can be tailored to various market conditions and risk appetites;

Factoid: The first recorded options trading occurred in ancient Greece‚ where individuals traded rights to olive harvests․

What is Forex Trading?

Forex trading‚ or foreign exchange trading‚ involves buying and selling currencies in the global marketplace․ The forex market is the largest and most liquid financial market in the world‚ with trillions of dollars changing hands daily․ Forex trading is based on the principle of profiting from the fluctuations in exchange rates between different currencies․ Currencies are traded in pairs‚ such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen)․

Key Characteristics of Forex Trading

- High Liquidity: The forex market is extremely liquid‚ allowing traders to enter and exit positions quickly․

- 24/5 Market: The forex market operates 24 hours a day‚ five days a week․

- Leverage: Forex trading typically involves high leverage‚ allowing traders to control large positions with a small amount of capital․

- Volatility: Currency exchange rates can be volatile‚ presenting both opportunities and risks․

Factoid: The Forex market never sleeps! Because it is a global market‚ trading takes place 24 hours a day‚ 5 days a week․

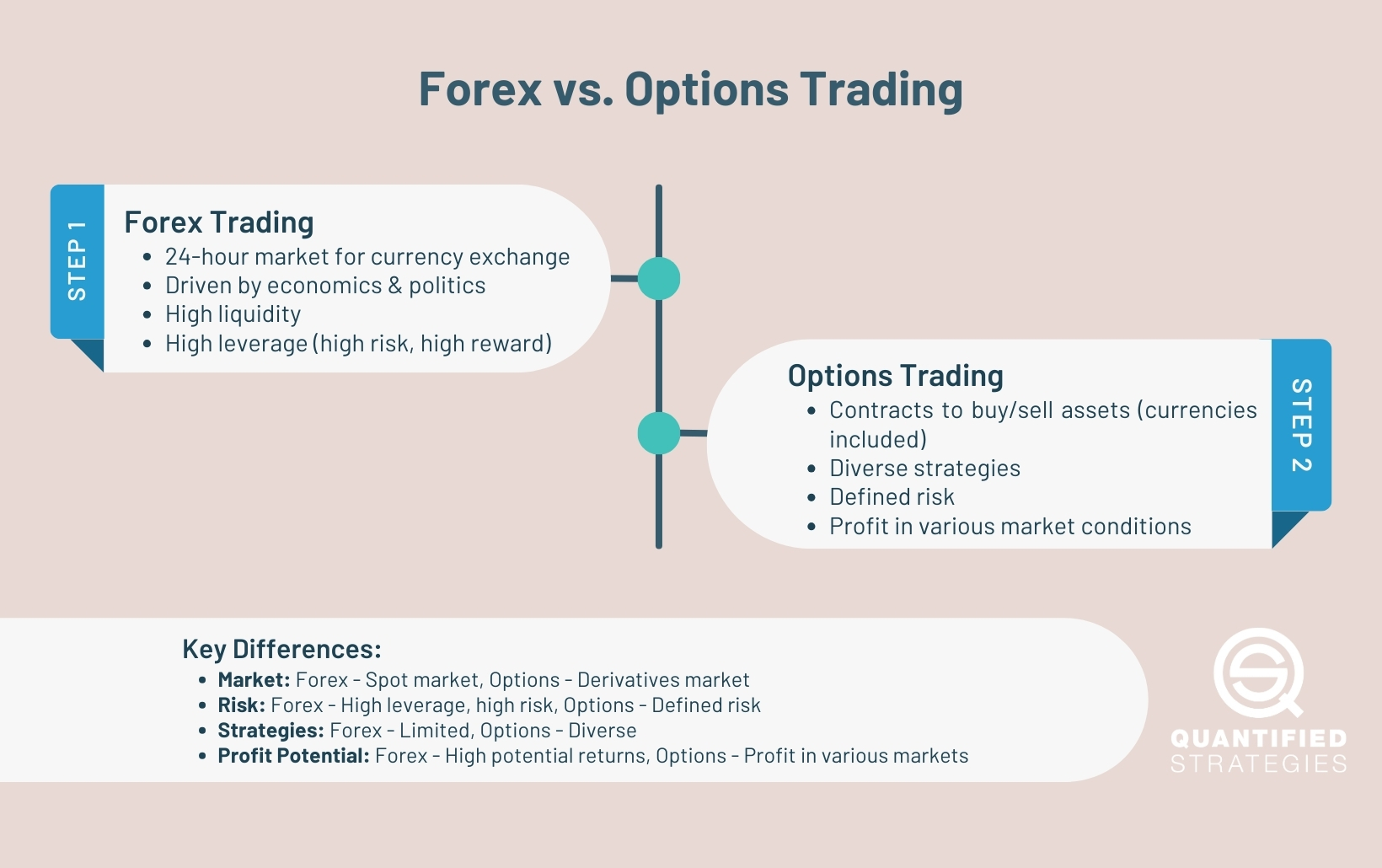

Options Trading vs․ Forex: Key Differences

Here’s a table summarizing the key differences between options trading and forex trading:

| Feature | Options Trading | Forex Trading |

|---|---|---|

| Underlying Asset | Stocks‚ ETFs‚ Commodities‚ Currencies | Currencies |

| Instrument | Contracts (call and put options) | Currency pairs |

| Market Hours | Varies depending on the underlying asset | 24 hours a day‚ 5 days a week |

| Leverage | Available‚ but typically lower than forex | High leverage is common |

| Risk | Defined risk for option buyers | Potentially unlimited risk |

| Complexity | Can be complex‚ requiring understanding of options strategies | Can be complex‚ requiring understanding of economic indicators and geopolitical events |

Which is Right for You?

The best choice between options trading and forex trading depends on your individual circumstances‚ risk tolerance‚ and trading goals․ If you prefer a market with defined risk and are interested in trading a variety of underlying assets‚ options trading might be a good fit․ If you prefer a highly liquid‚ 24/5 market and are comfortable with high leverage and volatility‚ forex trading might be more suitable․

FAQ: Options Trading vs․ Forex

Q: Is options trading riskier than forex trading?

A: Both involve risk․ Options buying has defined risk (premium paid)‚ while forex can have unlimited risk due to leverage․ Options selling can have significant risk․

Q: Which requires more capital to start?

A: Forex trading can often be started with less capital due to higher leverage‚ but options trading can also be started with a relatively small amount depending on the broker and strategy․

Q: Can I trade options on currency pairs?

A: Yes‚ currency options exist‚ but they are less common than trading currency pairs directly in the forex market․

Q: Which market is more volatile?

A: Both markets can be volatile‚ but the forex market is generally considered to be more volatile due to its high liquidity and global nature․

Q: Do I need a financial advisor to trade options or forex?

A: While not mandatory‚ it’s highly recommended to seek advice from a qualified financial advisor before engaging in either options or forex trading‚ especially if you are new to these markets․

Advanced Strategies in Options and Forex Trading

Once you understand the basics of options and forex trading‚ you can explore more advanced strategies․ These strategies often involve combining different instruments or using sophisticated risk management techniques․ However‚ they also come with increased complexity and potential for loss‚ so thorough understanding and careful execution are essential․

Advanced Options Trading Strategies

- Straddles and Strangles: These strategies involve buying both a call and a put option on the same underlying asset with the same expiration date․ Straddles have the same strike price‚ while strangles have different strike prices․ These strategies are used when a trader expects a significant price movement but is unsure of the direction․

- Covered Calls: This strategy involves owning shares of an underlying asset and selling call options on those shares․ It’s a conservative strategy that generates income but limits potential upside․

- Iron Condors: This strategy involves a combination of call and put options with four different strike prices․ It’s a neutral strategy that profits when the underlying asset remains within a specific range․

Advanced Forex Trading Strategies

- Carry Trade: This strategy involves borrowing a currency with a low interest rate and investing in a currency with a high interest rate․ The goal is to profit from the interest rate differential․

- Trend Following: This strategy involves identifying and following established trends in currency prices․ Traders use technical indicators to identify entry and exit points․

- Breakout Trading: This strategy involves identifying key support and resistance levels and entering trades when the price breaks through these levels․

Risk Management in Options and Forex

Regardless of whether you choose to trade options or forex‚ effective risk management is crucial for long-term success․ Without proper risk management‚ even the most profitable strategies can lead to significant losses․ Here are some key risk management techniques:

- Stop-Loss Orders: A stop-loss order automatically closes a position when the price reaches a predetermined level‚ limiting potential losses․

- Position Sizing: Position sizing involves determining the appropriate amount of capital to allocate to each trade based on your risk tolerance and account size․

- Diversification: Diversifying your portfolio across different assets or currency pairs can help reduce overall risk․

- Hedging: Hedging involves taking offsetting positions to protect against potential losses․

The Role of Technology in Modern Trading

Technology plays a significant role in both options and forex trading․ Advanced trading platforms provide real-time data‚ charting tools‚ and automated trading capabilities․ Here are some key technological advancements that have impacted the trading landscape:

- Algorithmic Trading: Algorithmic trading involves using computer programs to execute trades based on predefined rules․

- High-Frequency Trading (HFT): HFT involves using sophisticated algorithms and high-speed connections to execute a large number of orders in fractions of a second․

- Mobile Trading Apps: Mobile trading apps allow traders to monitor the markets and execute trades from anywhere with an internet connection․

Staying Informed and Educated

The financial markets are constantly evolving‚ so it’s essential to stay informed and continue learning․ Here are some resources for staying up-to-date on the latest market trends and trading strategies:

- Financial News Websites: Websites like Bloomberg‚ Reuters‚ and the Wall Street Journal provide up-to-date market news and analysis․

- Trading Forums and Communities: Online forums and communities can provide valuable insights and perspectives from other traders․

- Educational Courses and Seminars: Numerous educational courses and seminars are available to help traders improve their skills and knowledge․

Options trading and forex trading offer unique opportunities and challenges․ Understanding the key differences between these markets‚ developing effective trading strategies‚ and implementing robust risk management techniques are essential for success․ Whether you choose to trade options or forex‚ remember to approach the markets with discipline‚ patience‚ and a commitment to continuous learning․ Good luck!