Dealing with credit debt can feel overwhelming, and it might make you hesitant about taking other financial steps, like opening a new bank account; You might be wondering if your past financial struggles will prevent you from accessing essential banking services․ The good news is that having credit debt doesn’t automatically disqualify you from opening a new account․ However, it’s important to understand how your credit history and banking history can influence your application and what steps you can take to improve your chances of approval․

Understanding Your Credit History and Banking History

While credit debt primarily affects your credit score, your banking history is also crucial when opening a new account․ Banks typically review your banking history through services like ChexSystems to assess your past account management․ Negative entries, such as unpaid overdraft fees or closed accounts due to mismanagement, can make it harder to get approved․

How Credit Debt Impacts Your Ability to Open a Bank Account

Directly, credit card debt does not prevent you from opening a bank account․ Banks are more concerned with your banking history than your credit score․ However, if you owe a bank money (e․g․, from a previous overdraft), that bank may deny your application․

Here are some factors banks consider:

- ChexSystems Report: This report tracks your banking history, including bounced checks, unpaid overdrafts, and closed accounts․

- Credit Score (Indirectly): While not the primary factor, a very poor credit score might raise red flags about your overall financial responsibility․

- Outstanding Debt to the Bank: If you owe the bank money from a previous account, they will likely deny your application․

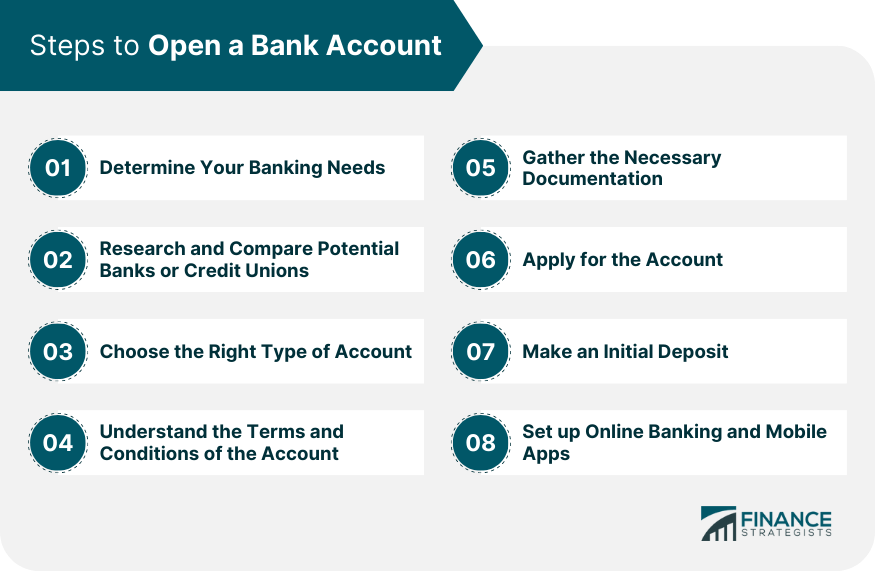

Steps to Take Before Applying for a New Account

Before applying for a new bank account, consider these steps to improve your chances of approval:

- Check Your ChexSystems Report: Obtain a copy of your ChexSystems report and dispute any inaccuracies․

- Pay Outstanding Debts to Banks: If you owe a bank money, prioritize paying it off․

- Consider Second Chance Banking: These accounts are designed for individuals with poor banking histories․

Second Chance Banking Options

If you’ve been denied a bank account due to your banking history, consider “second chance” banking options․ These accounts often have fewer features and higher fees but can help you re-establish a positive banking record․

Factoid: Second chance banking accounts typically require direct deposit and may limit transaction amounts initially․ After a period of responsible account management, you may be able to upgrade to a standard account․

Tips for Managing Your New Bank Account Responsibly

Once you’ve successfully opened a new bank account, it’s crucial to manage it responsibly to avoid future issues․

- Track Your Transactions: Monitor your account balance and transactions regularly․

- Avoid Overdrafts: Sign up for overdraft protection or link your account to a savings account․

- Pay Fees on Time: Ensure you pay any monthly fees or service charges promptly․

Factoid: Setting up automatic alerts for low balances can help you avoid overdraft fees and maintain a healthy account․ Many banks offer this service for free․

FAQ: Opening a Bank Account with Credit Debt

Q: Will my credit card debt prevent me from opening a checking account?

A: Not directly․ Banks primarily focus on your banking history, not your credit score․ However, a very poor credit score might raise concerns․

Q: What is ChexSystems, and how does it affect my application?

A: ChexSystems is a consumer reporting agency that tracks your banking history․ Negative entries, such as unpaid overdrafts, can make it harder to get approved․

Q: What if I owe a bank money from a previous account?

A: The bank you owe money to will likely deny your application․ Prioritize paying off the debt before applying for a new account․

Q: What is “second chance” banking?

A: Second chance banking accounts are designed for individuals with poor banking histories․ They often have fewer features and higher fees but can help you re-establish a positive banking record․

Q: How can I improve my chances of getting approved for a bank account?

A: Check your ChexSystems report, pay off any outstanding debts to banks, and consider second chance banking options․