Gold has captivated humanity for millennia, serving as a symbol of wealth, power, and enduring value. From ancient civilizations to modern financial markets, its allure remains strong. But in today’s complex investment landscape, is gold truly a worthwhile investment? This article delves into the pros and cons of investing in gold, exploring its historical performance, potential benefits, and inherent risks, helping you make an informed decision about whether gold aligns with your financial goals.

Understanding Gold as an Investment

Gold is often considered a safe-haven asset, meaning it tends to hold its value or even increase in times of economic uncertainty, market volatility, or geopolitical instability. This perceived safety stems from its limited supply and inherent value, unlike fiat currencies which can be printed at will by governments.

- Safe Haven Asset: A store of value during economic downturns.

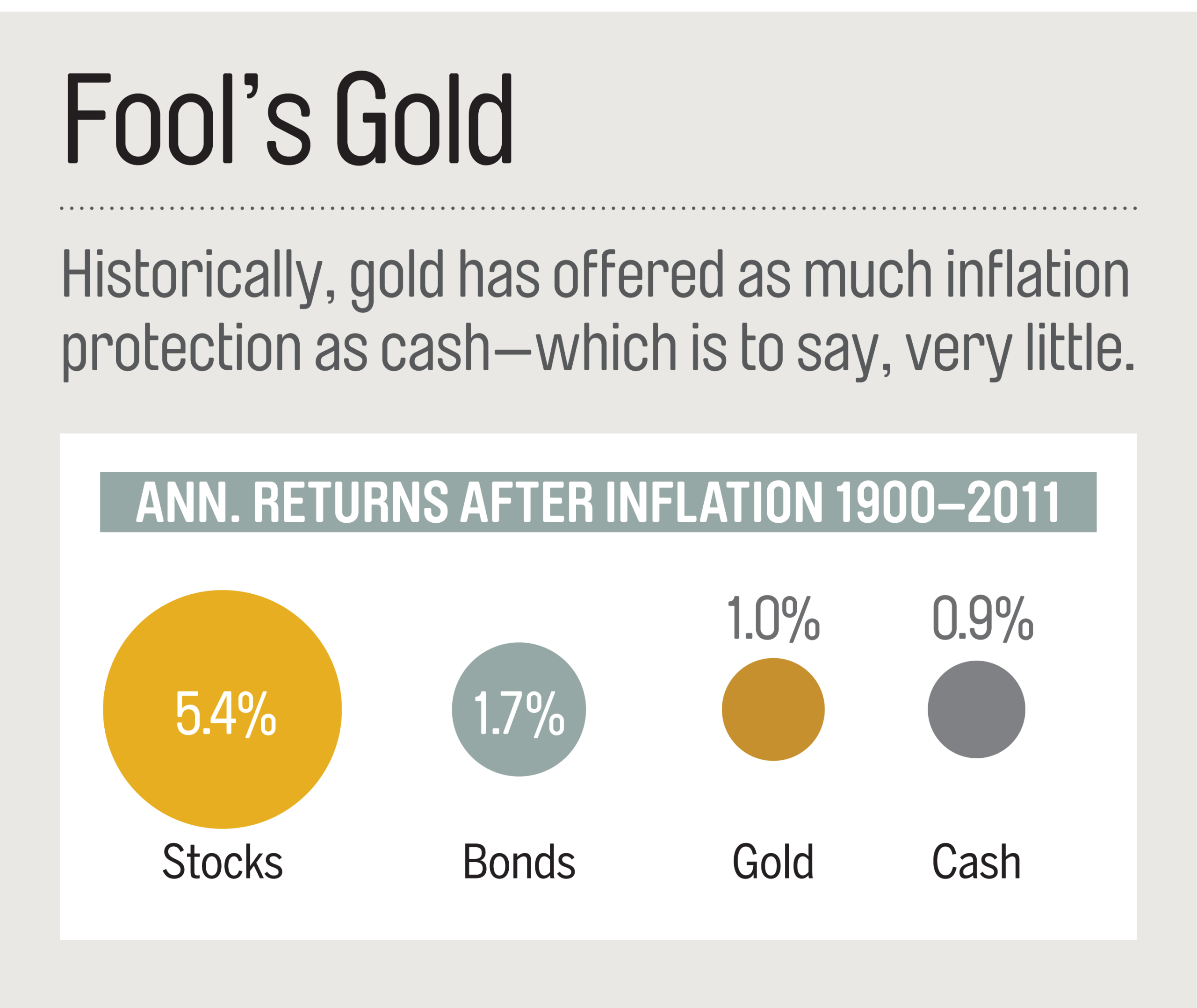

- Hedge Against Inflation: Historically, gold has maintained its purchasing power over time.

- Portfolio Diversification: Gold’s price often moves independently of stocks and bonds.

Different Ways to Invest in Gold

There are several avenues for investing in gold, each with its own advantages and disadvantages:

- Physical Gold: Buying gold bars, coins, or jewelry.

- Gold ETFs (Exchange-Traded Funds): Funds that track the price of gold.

- Gold Mining Stocks: Investing in companies that mine gold.

- Gold Futures Contracts: Agreements to buy or sell gold at a future date.

The Pros of Investing in Gold

Investing in gold offers several potential benefits:

- Hedge Against Inflation: Gold can act as a buffer against rising prices.

- Diversification: Gold’s low correlation with other assets can reduce portfolio risk.

- Safe Haven: Gold tends to perform well during times of economic turmoil.

- Store of Value: Gold retains its value over long periods.

Factoid: Throughout history, gold has been used as currency, jewelry, and even in dentistry. Its versatility contributes to its enduring value.

The Cons of Investing in Gold

Despite its allure, investing in gold also carries certain risks:

- No Income Generation: Gold doesn’t pay dividends or interest.

- Price Volatility: Gold prices can fluctuate significantly in the short term.

- Storage Costs: Physical gold requires secure storage, which can be expensive.

- Opportunity Cost: Investing in gold means missing out on potential returns from other assets.

Factors Influencing Gold Prices

Several factors can influence the price of gold, including:

- Interest Rates: Higher interest rates can make gold less attractive.

- Inflation: High inflation can boost gold prices.

- Geopolitical Events: Uncertainty can drive investors to gold.

- Currency Fluctuations: A weaker US dollar can increase gold prices.

Is Gold Right for You?

Ultimately, the decision of whether or not to invest in gold depends on your individual circumstances, risk tolerance, and investment goals. Consider your overall portfolio and financial objectives before allocating a portion of your assets to gold.

Before investing in gold, it’s crucial to conduct thorough research and consult with a financial advisor. They can help you assess your risk tolerance, understand the potential benefits and risks of gold investing, and determine if it aligns with your overall financial strategy.

FAQ: Investing in Gold Q: How much of my portfolio should I allocate to gold?

A: A common recommendation is to allocate 5-10% of your portfolio to gold for diversification purposes. However, this can vary depending on your risk tolerance and investment goals.

Q: Is physical gold a better investment than gold ETFs?

A: It depends on your preferences. Physical gold provides direct ownership, but requires secure storage. Gold ETFs offer liquidity and ease of trading, but you don’t physically own the gold.

Q: Should I invest in gold mining stocks?

A: Gold mining stocks can offer higher potential returns, but they also carry greater risk than physical gold or gold ETFs due to company-specific factors.

Q: Is gold a good investment for retirement?

A: Gold can be a component of a diversified retirement portfolio, providing a hedge against inflation and market volatility. However, it’s essential to consider your overall risk tolerance and time horizon.

Q: What are the tax implications of investing in gold?

A: The tax implications of investing in gold vary depending on the form of investment and your location. Physical gold may be subject to sales tax, while profits from selling gold ETFs or gold mining stocks are typically subject to capital gains tax. Consult with a tax advisor for specific guidance.

Investing in gold presents both opportunities and risks. Its role as a safe-haven asset and a hedge against inflation can be appealing, particularly during times of economic uncertainty. However, gold’s lack of income generation, price volatility, and storage costs are important considerations. By carefully evaluating your financial goals, risk tolerance, and investment options, you can determine whether gold is a worthwhile addition to your portfolio.

Remember that no investment is guaranteed to generate profits, and gold is no exception. Diversification remains a cornerstone of sound financial planning, and gold should be considered as one component of a well-balanced portfolio, not a replacement for other asset classes.

Staying informed about market trends, economic indicators, and geopolitical events is crucial for making informed decisions about gold investing. Consult with financial professionals to receive personalized advice tailored to your unique circumstances and financial objectives. By taking a disciplined and informed approach, you can navigate the complexities of gold investing and potentially reap its benefits while mitigating its risks.

Beyond individual investors, central banks also play a significant role in the gold market. Many central banks hold gold reserves as part of their foreign exchange holdings, using it to diversify their assets and provide stability to their currencies. Changes in central bank gold policies can have a substantial impact on gold prices.

Monitoring the Gold Market

Keeping a close eye on the gold market is crucial for any investor considering adding gold to their portfolio. This involves tracking several key indicators:

- Spot Price of Gold: The current market price for immediate delivery of gold.

- Gold Futures Prices: Prices for gold to be delivered at a future date.

- Inflation Rates: Rising inflation can boost gold prices.

- Interest Rate Trends: Higher interest rates can negatively impact gold.

- Geopolitical Events: Political instability can drive investors to gold.

- Currency Movements: A weaker US dollar typically supports higher gold prices.

Resources for Staying Informed

Numerous resources are available to help you stay informed about the gold market:

- Financial News Websites: Reputable sources like Bloomberg, Reuters, and the Wall Street Journal.

- Gold Industry Associations: Organizations like the World Gold Council provide valuable data and insights.

- Brokerage Firms: Most brokerage firms offer research and analysis on gold and other commodities.

- Financial Advisors: Consulting with a financial advisor can provide personalized guidance.

Factoid: Gold is virtually indestructible. Almost all the gold that has ever been mined still exists today.

Alternative Investments to Gold

While gold is a popular choice for diversification and hedging, several alternative investments can also serve similar purposes:

- Treasury Bonds: Government-backed bonds considered safe-haven assets.

- Real Estate: Tangible assets that can appreciate in value over time.

- Commodities: Other commodities like silver, platinum, and oil.

- Cryptocurrencies: Digital assets with the potential for high returns, but also high risk.

Each of these alternatives has its own set of risks and rewards, and the best choice for you will depend on your individual circumstances and investment goals. Diversifying across multiple asset classes can help to mitigate risk and enhance returns.

Final Thoughts: A Balanced Perspective on Gold

Investing in gold requires a balanced perspective. While it can offer certain benefits, it’s not a guaranteed path to riches. It’s crucial to understand the risks involved, conduct thorough research, and consult with financial professionals before making any investment decisions.

Remember that gold is just one piece of the puzzle when it comes to building a successful investment portfolio. A well-diversified portfolio that includes stocks, bonds, real estate, and other asset classes is more likely to achieve long-term financial goals than relying solely on gold.

By taking a disciplined, informed, and diversified approach to investing, you can increase your chances of achieving financial success and building a secure future. Gold can play a role in that strategy, but it should be viewed as a component of a broader plan, not a standalone solution.

Future of Gold Investing

The future of gold investing remains uncertain, influenced by various factors such as global economic conditions, geopolitical events, and technological advancements. As the world evolves, so too will the role of gold in the investment landscape. Staying informed and adapting to changing market dynamics will be crucial for investors seeking to navigate the complexities of gold investing in the years to come. Continuously evaluating your investment strategy and seeking professional guidance will help you make informed decisions and optimize your portfolio’s performance.