Investing $20,000 in the stock market can seem daunting, but with a well-thought-out strategy, it can be a significant step towards achieving your financial goals. The key is to approach it with knowledge, patience, and a clear understanding of your risk tolerance. This guide offers a unique perspective on how to strategically allocate your funds, diversify your portfolio, and navigate the complexities of the market to make informed decisions about how to invest 20000. Remember, investing always carries risk, and past performance is not indicative of future results, so careful consideration is paramount.

Understanding Your Investment Profile

Before diving into specific investment options, it’s crucial to assess your individual investment profile. This involves understanding your risk tolerance, investment timeline, and financial goals.

- Risk Tolerance: Are you comfortable with the possibility of losing a portion of your investment in exchange for potentially higher returns, or do you prefer a more conservative approach?

- Investment Timeline: How long do you plan to keep your money invested? A longer timeline generally allows for greater risk-taking.

- Financial Goals: What are you hoping to achieve with your investment? Are you saving for retirement, a down payment on a house, or another specific goal?

Building a Diversified Portfolio

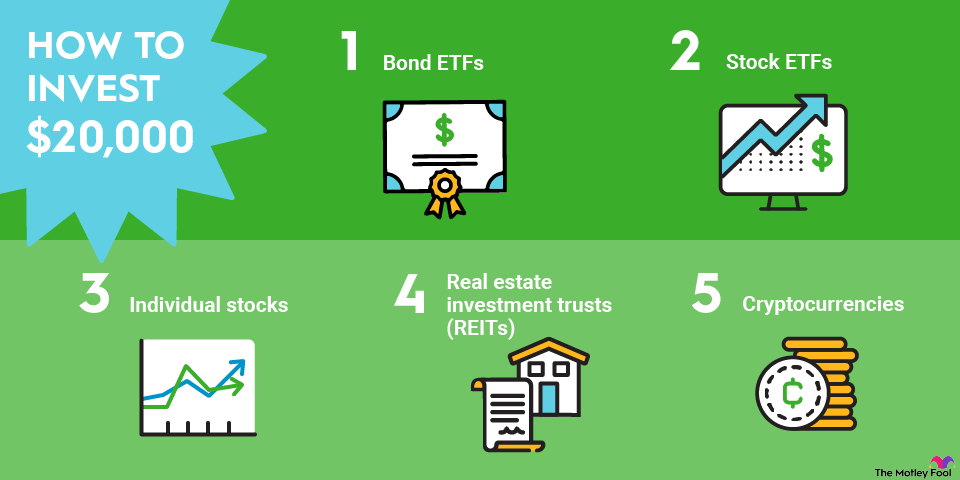

Diversification is a cornerstone of successful investing. Spreading your $20,000 across different asset classes, industries, and geographic regions can help mitigate risk. Here’s a potential allocation strategy:

- Stocks (60% — $12,000): Invest in a mix of large-cap, mid-cap, and small-cap stocks. Consider using Exchange-Traded Funds (ETFs) or mutual funds to gain broad market exposure.

- Bonds (30%, $6,000): Bonds offer a more stable return than stocks and can help balance your portfolio. Consider investing in government bonds, corporate bonds, or a bond ETF.

- Real Estate (10%, $2,000): While $2,000 won’t buy you a property, you can invest in Real Estate Investment Trusts (REITs) to gain exposure to the real estate market.

Choosing Your Investment Vehicles

Several investment vehicles can help you achieve your diversification goals.

- Exchange-Traded Funds (ETFs): ETFs are baskets of stocks or bonds that trade on exchanges like individual stocks. They offer instant diversification and are generally low-cost.

- Mutual Funds: Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of securities.

- Individual Stocks: Investing in individual stocks can offer the potential for higher returns, but it also comes with greater risk. Thorough research is essential before investing in individual stocks.

A Unique Investment Strategy: The “Core and Satellite” Approach

A unique approach to investing your $20,000 is the “core and satellite” strategy. This involves building a core portfolio of low-cost, diversified ETFs or mutual funds and then adding satellite positions in individual stocks or other investments that you believe have the potential for higher growth.

Example Allocation:

- Core (80% ⎻ $16,000):

- S&P 500 ETF (40% — $8,000)

- Total Bond Market ETF (40% ⎻ $8,000)

- Satellite (20% ⎻ $4,000):

- Technology Stock (10% ⎻ $2,000)

- Renewable Energy Stock (10% ⎻ $2,000)

FAQ

- Q: How often should I rebalance my portfolio?

- A: Rebalance your portfolio at least annually to maintain your desired asset allocation.

- Q: What are the tax implications of investing?

- A: Investment gains are generally subject to capital gains taxes. Consult with a tax advisor for personalized advice.

- Q: Should I hire a financial advisor?

- A: A financial advisor can provide personalized investment advice, but it’s important to choose one who is fee-only and acts as a fiduciary.

Monitoring and Adjusting Your Portfolio

Investing is not a one-time event. It’s crucial to regularly monitor your portfolio’s performance and make adjustments as needed. This may involve rebalancing your asset allocation, selling underperforming investments, and adding new investments that align with your goals.

Ultimately, the best way to invest 20000 is to create a personalized investment plan that aligns with your individual circumstances and goals. Remember to conduct thorough research, diversify your portfolio, and stay informed about market trends. With a disciplined approach and a long-term perspective, you can increase your chances of achieving your financial aspirations.

The Importance of Long-Term Investing

The stock market can be volatile in the short term, but historically, it has provided strong returns over the long term. Avoid making emotional decisions based on short-term market fluctuations. Instead, focus on your long-term investment goals and stick to your investment plan. Dollar-cost averaging, investing a fixed amount of money at regular intervals, can help mitigate the impact of market volatility.

Avoiding Common Investment Mistakes

Many investors make common mistakes that can derail their investment success. Here are a few to avoid:

- Chasing Hot Stocks: Investing in stocks based on hype or recent performance is a recipe for disaster.

- Ignoring Fees: High fees can eat into your investment returns. Choose low-cost investment options whenever possible.

- Failing to Diversify: Putting all your eggs in one basket can significantly increase your risk.

- Panic Selling: Selling your investments during a market downturn can lock in losses.

Resources for Further Learning

Numerous resources are available to help you learn more about investing. Consider exploring the following:

- Online Brokerage Websites: Most online brokerages offer educational resources, including articles, videos, and webinars.

- Financial News Websites: Stay informed about market trends and economic news by reading reputable financial news websites.

- Books on Investing: Many excellent books on investing can provide valuable insights and strategies.

- Financial Podcasts: Listen to financial podcasts to learn from experts and stay up-to-date on market developments.

A Final Word on Investing $20,000

Learning how to invest 20000 wisely is a journey, not a destination. Continuously educate yourself, adapt your strategy as needed, and remain patient. By following these guidelines, you can increase your chances of building a successful investment portfolio and achieving your financial goals. Remember to consult with a qualified financial advisor for personalized advice tailored to your specific situation.

Beyond the Basics: Exploring Advanced Investment Strategies

Once you’ve mastered the fundamentals of investing, you might consider exploring more advanced strategies to potentially enhance your returns. However, remember that these strategies often come with increased risk and require a deeper understanding of the market.

Options Trading

Options contracts give you the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Options trading can be used for hedging, speculation, or income generation. However, it’s a complex strategy that requires careful planning and risk management.

Margin Investing

Margin investing involves borrowing money from your broker to purchase securities. This can amplify your gains, but it can also magnify your losses. Margin investing is only suitable for experienced investors with a high-risk tolerance.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling losing investments to offset capital gains taxes. This can help reduce your overall tax burden and improve your after-tax returns. However, it’s important to be aware of the wash-sale rule, which prohibits you from repurchasing the same or substantially similar security within 30 days of selling it for a loss.

The Psychological Side of Investing

Investing is not just about numbers and charts; it’s also about managing your emotions. Fear and greed can often lead to poor investment decisions. It’s crucial to develop a disciplined approach and avoid making impulsive decisions based on market fluctuations.

Overcoming Cognitive Biases

Cognitive biases are mental shortcuts that can lead to irrational investment decisions. Some common cognitive biases include:

- Confirmation Bias: Seeking out information that confirms your existing beliefs and ignoring information that contradicts them.

- Anchoring Bias: Relying too heavily on the first piece of information you receive, even if it’s irrelevant.

- Loss Aversion: Feeling the pain of a loss more strongly than the pleasure of an equivalent gain.

By being aware of these biases, you can take steps to mitigate their impact on your investment decisions.

Staying Informed and Adapting to Change

The investment landscape is constantly evolving. New technologies, economic trends, and regulatory changes can all impact the market. It’s essential to stay informed and adapt your investment strategy as needed.

Following Market News

Stay up-to-date on market news by reading reputable financial news websites, subscribing to financial newsletters, and following financial experts on social media. However, be critical of the information you consume and avoid relying on unsubstantiated rumors or hype.

Reviewing Your Portfolio Regularly

Review your portfolio at least annually to ensure that it still aligns with your goals and risk tolerance. Make adjustments as needed to rebalance your asset allocation, sell underperforming investments, and add new investments that reflect your evolving circumstances.

The Power of Compounding

Compounding is the process of earning returns on your initial investment and then earning returns on those returns. Over time, compounding can significantly increase your wealth. The earlier you start investing, the more time your money has to grow through the power of compounding.

To illustrate the power of compounding, consider this example: If you invest $20,000 and earn an average annual return of 7%, your investment will double in approximately 10 years. After 20 years, your investment will be worth over $77,000. And after 30 years, it will be worth over $152,000. This demonstrates the importance of long-term investing and the potential for compounding to build significant wealth.

Remember that investing involves risk, and there’s no guarantee of returns. However, by following a disciplined approach, diversifying your portfolio, and staying informed, you can increase your chances of achieving your financial goals. And that is the best way to invest 20000 for long-term growth.