Navigating the world of Forex trading requires a keen understanding of market dynamics, and at the heart of this understanding lies access to timely and accurate information. Knowing how to check Forex news effectively is not just a suggestion; it’s a necessity for making informed trading decisions. The Forex market is incredibly sensitive to global events, economic indicators, and political developments, all of which can trigger significant price fluctuations. Therefore, mastering how to check Forex news and interpret its potential impact is crucial for both novice and experienced traders alike. This guide will provide you with the essential tools and strategies to stay ahead of the curve.

Understanding the Importance of Forex News

The Forex market operates 24 hours a day, five days a week, making it highly susceptible to news events happening across different time zones. These events can range from central bank announcements and economic data releases to geopolitical tensions and natural disasters. The impact of these events on currency values can be immediate and substantial.

Key Types of Forex News to Monitor:

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and retail sales data.

- Central Bank Announcements: Interest rate decisions, monetary policy statements, and quantitative easing programs.

- Political Events: Elections, policy changes, and international relations.

- Geopolitical Risks: Wars, conflicts, and trade disputes.

- Market Sentiment: Overall investor confidence and risk appetite.

Where to Find Reliable Forex News

Accessing credible and up-to-date news sources is paramount. Avoid relying solely on social media or unverified websites. Instead, focus on established financial news outlets and reputable Forex analysis platforms.

Recommended News Sources:

- Financial News Websites: Bloomberg, Reuters, CNBC, and MarketWatch.

- Forex Brokers’ News Feeds: Many brokers offer in-house news and analysis services.

- Economic Calendars: Websites like Forex Factory and DailyFX provide comprehensive economic calendars.

- Central Bank Websites: Access official announcements directly from central banks like the Federal Reserve, European Central Bank, and Bank of England.

How to Interpret Forex News

Simply reading the news is not enough. You need to understand how different events can influence currency values. Consider the following factors:

The Surprise Factor: How does the actual data compare to market expectations? A significant deviation from forecasts can trigger a larger market reaction.

The Context: What is the overall economic climate? Is the economy growing or contracting?

The Central Bank’s Response: How is the central bank likely to react to the news? Will they adjust interest rates or implement other policy changes?

For example, a higher-than-expected inflation rate might lead to expectations of interest rate hikes, which could strengthen the currency. Conversely, a weak GDP report could weaken the currency.

Tools for Staying Updated

Several tools can help you stay informed about Forex news in real-time:

Economic Calendar Alerts: Set up alerts for key economic data releases.

News Aggregators: Use news aggregators to consolidate news from multiple sources.

Mobile Apps: Download Forex news apps to receive notifications on your smartphone.

FAQ: Checking Forex News

Q: How often should I check Forex news?

A: It depends on your trading style. Day traders should monitor news throughout the day, while long-term investors may only need to check news a few times a week.

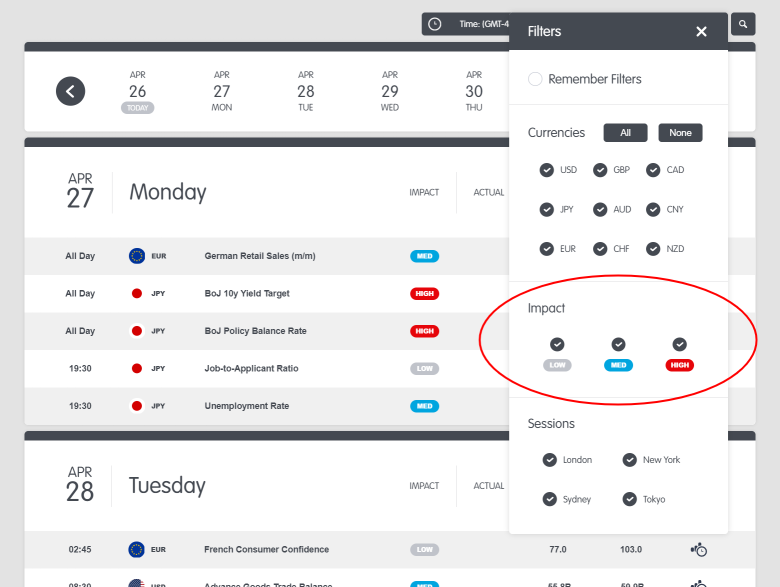

Q: What is an economic calendar?

A: An economic calendar is a tool that lists upcoming economic events and data releases, along with their expected impact on the market.

Q: How do I know which news events are most important?

A: Economic calendars typically rank news events by their potential impact (high, medium, or low). Focus on high-impact events.

Q: Can I rely solely on news for my trading decisions?

A: No. News should be used in conjunction with technical analysis and other trading strategies.

Remember, the Forex market is dynamic and ever-changing, so staying adaptable and continuously refining your news analysis skills is essential for long-term success. Don’t be afraid to experiment with different news sources and analytical techniques to find what works best for you. The more informed you are, the better equipped you’ll be to navigate the complexities of the Forex market and achieve your trading goals.

Advanced Strategies for Forex News Analysis

Beyond simply reading and interpreting news releases, advanced traders often employ more sophisticated strategies to gain an edge. These strategies involve analyzing the nuances of news reports, understanding market sentiment, and anticipating potential market reactions.

Sentiment Analysis

Sentiment analysis involves gauging the overall mood of the market. Are traders generally bullish (optimistic) or bearish (pessimistic)? News headlines and articles can provide clues about market sentiment. For example, a series of positive economic reports might lead to increased bullish sentiment, while negative news could trigger a bearish reaction.

Intermarket Analysis

Intermarket analysis involves examining the relationships between different asset classes, such as currencies, stocks, bonds, and commodities. News events that affect one asset class can often have ripple effects on others. For example, a rise in oil prices could weaken currencies of countries that are heavily reliant on oil imports.

Event-Driven Trading

Event-driven trading involves taking positions based on anticipated news events. This requires careful planning and risk management. Traders often use options or other derivative instruments to hedge their positions and limit potential losses.

Common Mistakes to Avoid

Even experienced traders can make mistakes when analyzing Forex news. Here are some common pitfalls to avoid:

- Ignoring the Big Picture: Don’t focus solely on individual news events. Consider the overall economic context and long-term trends.

- Overreacting to News: Avoid making impulsive trading decisions based on short-term market fluctuations.

- Relying on Unverified Sources: Always verify news from multiple reputable sources.

- Failing to Manage Risk: Use stop-loss orders and other risk management techniques to protect your capital.

The Future of Forex News Analysis

The field of Forex news analysis is constantly evolving. With the rise of artificial intelligence (AI) and machine learning, new tools are being developed to automate news analysis and identify trading opportunities. These tools can analyze vast amounts of data in real-time, providing traders with valuable insights that would be impossible to obtain manually.

AI-Powered News Analysis

AI-powered news analysis tools can automatically scan news articles, social media posts, and other sources of information to identify relevant events and assess their potential impact on the Forex market. These tools can also generate trading signals based on their analysis.

Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on pre-defined rules. These rules can be based on news events, technical indicators, or other factors. Algorithmic trading can help traders to automate their trading strategies and execute trades more efficiently.

Ultimately, the ability to effectively analyze Forex news remains a critical skill for any successful trader. By staying informed, adapting to new technologies, and continuously refining your analytical skills, you can increase your chances of success in the dynamic and challenging world of Forex trading. Remember that understanding how to check Forex news is a continuous journey, not a destination, and consistent effort will yield the best results.