The Forex market‚ known for its volatility and complexity‚ often presents traders with a daunting challenge: identifying profitable trading opportunities․ Harmonic scanners have emerged as a popular tool to navigate this intricate landscape․ These scanners utilize mathematical and geometrical patterns to predict potential price movements‚ offering a systematic approach to technical analysis․ Understanding how these scanners work and their limitations is crucial for any trader considering incorporating them into their strategy․ This article delves into the intricacies of harmonic scanners‚ providing a comprehensive overview of their functionality‚ benefits‚ and potential drawbacks․

What is a Harmonic Scanner?

A harmonic scanner is a software tool used in Forex trading to identify potential harmonic patterns on price charts․ These patterns are based on specific Fibonacci ratios and geometrical structures‚ suggesting areas where the price might reverse or continue its trend․ The scanner automatically searches for these patterns‚ saving traders the time and effort of manually analyzing charts․

Key Components of Harmonic Patterns

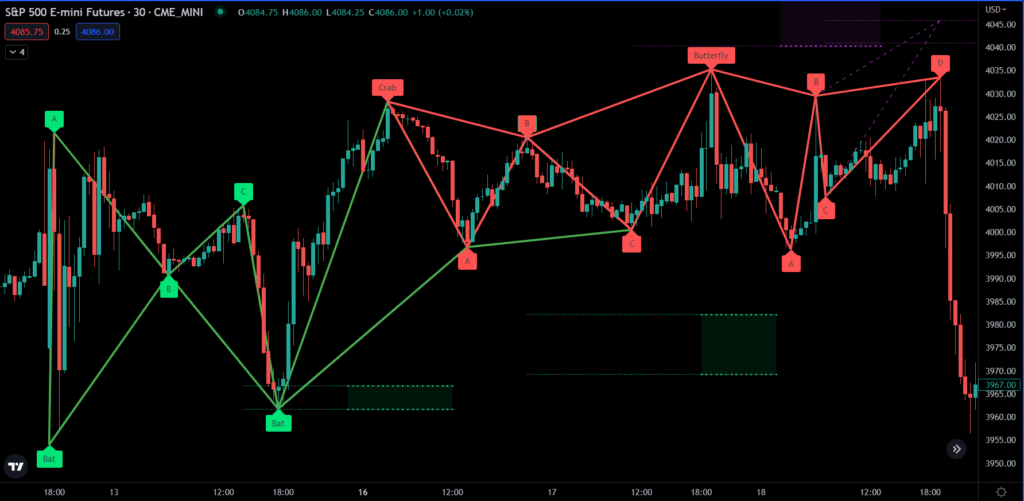

Harmonic patterns consist of specific points (labeled X‚ A‚ B‚ C‚ and D) connected by lines․ The distances between these points are related by Fibonacci ratios․ Common harmonic patterns include:

- Gartley: A classic pattern that indicates a potential reversal․

- Butterfly: Similar to the Gartley‚ but with a different Fibonacci ratio structure․

- Crab: Another reversal pattern‚ often characterized by extreme price swings․

- Bat: A pattern that can indicate both bullish and bearish opportunities․

- Cypher: A more complex pattern that requires careful analysis․

Factoid: The Fibonacci sequence (0‚ 1‚ 1‚ 2‚ 3‚ 5‚ 8‚ 13‚ 21․․․) is a series of numbers where each number is the sum of the two preceding ones․ These numbers appear frequently in nature and are used extensively in technical analysis‚ including harmonic patterns․

How Harmonic Scanners Work

Harmonic scanners analyze price charts in real-time‚ searching for patterns that match predefined harmonic ratios․ They typically use algorithms to identify potential X‚ A‚ B‚ C‚ and D points․ Once a pattern is identified‚ the scanner alerts the trader‚ providing information about the pattern type‚ potential entry points‚ and target prices․

Benefits of Using a Harmonic Scanner

- Time-saving: Automates the process of identifying harmonic patterns․

- Objective analysis: Reduces emotional bias in trading decisions․

- Increased efficiency: Allows traders to monitor multiple currency pairs simultaneously․

- Improved accuracy: Helps identify potential trading opportunities with greater precision․

Limitations of Harmonic Scanners

While harmonic scanners offer several advantages‚ it’s important to be aware of their limitations:

- False signals: Scanners can generate false signals‚ leading to incorrect trading decisions․

- Pattern subjectivity: The interpretation of harmonic patterns can be subjective‚ leading to variations in analysis․

- Lagging indicators: Harmonic patterns are based on past price data‚ which may not always accurately predict future price movements․

- Over-reliance: Relying solely on harmonic scanners without considering other factors can be risky․

Tips for Using Harmonic Scanners Effectively

To maximize the effectiveness of harmonic scanners‚ consider the following tips:

- Combine with other indicators: Use harmonic scanners in conjunction with other technical indicators‚ such as moving averages and RSI‚ to confirm signals․

- Practice risk management: Always use stop-loss orders to limit potential losses․

- Backtest your strategy: Test your trading strategy using historical data to evaluate its performance․

- Stay informed: Keep up-to-date with market news and economic events that could affect your trades․

FAQ ⎯ Frequently Asked Questions

Are harmonic scanners guaranteed to provide profitable trades?

No‚ harmonic scanners are not guaranteed to provide profitable trades․ They are tools that can help identify potential trading opportunities‚ but they should be used in conjunction with other analysis techniques and risk management strategies․

Do I need to understand Fibonacci ratios to use a harmonic scanner?

While it’s not strictly necessary‚ understanding Fibonacci ratios will help you better interpret the signals generated by the scanner and make more informed trading decisions․

What is the best harmonic scanner?

The “best” harmonic scanner depends on your individual needs and preferences․ Some popular options include Autochartist‚ ZUP‚ and dedicated scanner platforms offered by brokers․ Research and compare different scanners to find one that suits your trading style and budget․

Can I use harmonic scanners on all currency pairs?

Yes‚ harmonic scanners can be used on all currency pairs‚ as well as other financial instruments like stocks and commodities․ However‚ the effectiveness of the patterns may vary depending on the specific market and its volatility․

How much do harmonic scanners cost?

The cost of harmonic scanners varies depending on the provider and features offered․ Some scanners are free‚ while others require a subscription fee․ Consider your budget and trading needs when choosing a scanner․

Advanced Harmonic Scanner Techniques

Beyond the basic identification of harmonic patterns‚ advanced users often employ more sophisticated techniques to refine their trading strategies․ These techniques involve filtering signals‚ incorporating confluence factors‚ and adapting pattern recognition to specific market conditions․

Filtering Harmonic Scanner Signals

One common approach is to filter signals based on volume and volatility․ High volume confirms the strength of a pattern‚ while volatility measures help assess the risk associated with a potential trade․ Traders might also use moving averages or trendlines to confirm the direction of the overall trend before acting on a harmonic pattern signal․

Confluence Factors in Harmonic Trading

Confluence refers to the convergence of multiple technical indicators or patterns at a specific price level․ When a harmonic pattern completes near a significant support or resistance level‚ or coincides with a Fibonacci retracement‚ the potential for a successful trade increases․ This convergence of factors strengthens the likelihood of a price reversal or continuation․

Adapting to Market Conditions

Different market conditions require different approaches to harmonic trading․ In trending markets‚ traders might focus on patterns that signal trend continuation‚ while in range-bound markets‚ reversal patterns are more likely to be effective․ Understanding the market context and adjusting pattern recognition accordingly is crucial for success․

Factoid: Backtesting different harmonic pattern strategies across various currency pairs and timeframes can provide valuable insights into their performance under different market conditions․ This allows traders to fine-tune their approach and optimize their trading parameters․

Integrating Harmonic Scanners with Automated Trading Systems

Many traders are now integrating harmonic scanners with automated trading systems (ATS)‚ also known as expert advisors (EAs)‚ to automate the process of identifying and trading harmonic patterns․ This allows for 24/7 monitoring of the market and potentially faster execution of trades․

Benefits of Automation

- Round-the-clock monitoring: EAs can continuously scan the market for harmonic patterns‚ even when the trader is not actively monitoring the charts․

- Faster execution: Automated systems can execute trades more quickly than humans‚ potentially capturing better entry and exit points․

- Reduced emotional bias: EAs eliminate emotional decision-making‚ ensuring that trades are based solely on predefined rules and criteria․

Challenges of Automation

Despite the benefits‚ automating harmonic trading also presents challenges․ It’s crucial to carefully backtest and optimize the EA to ensure its profitability and reliability․ Furthermore‚ traders need to monitor the system closely to identify and address any potential issues․

The Future of Harmonic Scanning

As technology continues to evolve‚ harmonic scanners are likely to become even more sophisticated and accurate․ The integration of artificial intelligence (AI) and machine learning (ML) could lead to scanners that can automatically adapt to changing market conditions and identify patterns with greater precision․ Furthermore‚ the development of more user-friendly interfaces and mobile applications will make harmonic scanning more accessible to a wider range of traders․

Harmonic scanners can be a valuable tool for Forex traders looking to identify potential trading opportunities based on mathematical and geometrical patterns․ However‚ it’s crucial to understand their limitations and use them in conjunction with other technical indicators and risk management strategies․ By mastering the art of harmonic trading and staying informed about the latest developments in scanner technology‚ traders can potentially improve their trading performance and achieve their financial goals․