Many people new to the world of finance often wonder if the Forex market and the stock market are the same. While both offer opportunities for investment and potential profit‚ they operate in fundamentally different ways. Understanding these distinctions is crucial for making informed investment decisions and choosing the market that best aligns with your financial goals and risk tolerance. This article will explore the key differences between Forex and the stock market‚ helping you navigate the complexities of each.

What is Forex?

Forex‚ short for foreign exchange‚ is the global decentralized marketplace where currencies are traded. It’s the largest and most liquid financial market in the world‚ with trillions of dollars changing hands daily. Forex trading involves buying one currency while simultaneously selling another. The goal is to profit from fluctuations in exchange rates.

Key Characteristics of Forex:

- Decentralized: No central exchange or governing body.

- High Liquidity: Easy to buy and sell currencies at any time.

- 24/5 Trading: Open 24 hours a day‚ five days a week.

- Leverage: Allows traders to control large positions with relatively small capital.

What is the Stock Market?

The stock market is a place where shares of publicly traded companies are bought and sold. When you buy a stock‚ you’re essentially buying a small piece of ownership in that company. The value of a stock can fluctuate based on various factors‚ including company performance‚ industry trends‚ and overall economic conditions.

Key Characteristics of the Stock Market:

- Centralized Exchanges: Trading occurs on exchanges like the New York Stock Exchange (NYSE) or NASDAQ.

- Lower Liquidity (compared to Forex): Liquidity varies depending on the stock.

- Limited Trading Hours: Typically open during standard business hours.

- Dividends: Some companies pay dividends to shareholders.

Key Differences Between Forex and Stock Market

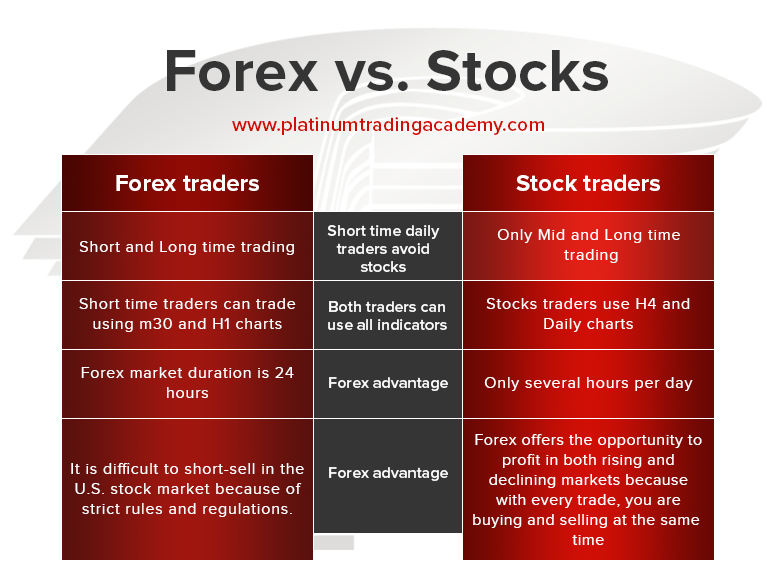

While both markets offer investment opportunities‚ several key differences set them apart:

- Trading Instrument: Forex trades currencies; the stock market trades shares of companies.

- Market Structure: Forex is decentralized; the stock market is centralized.

- Trading Hours: Forex is open 24/5; the stock market has limited hours.

- Leverage: Forex typically offers higher leverage than the stock market.

- Factors Influencing Price: Forex prices are influenced by economic indicators and geopolitical events; stock prices are influenced by company performance and industry trends.

Factoid: The Forex market sees an average daily trading volume of over $6 trillion‚ dwarfing the daily trading volume of all the world’s stock markets combined.

Pros and Cons of Forex Trading

Pros:

- High liquidity

- 24/5 trading

- Potential for high leverage

- Opportunity to profit in both rising and falling markets

Cons:

- High risk due to leverage

- Requires in-depth knowledge of economic indicators

- Volatility can lead to rapid losses

Pros and Cons of Stock Market Investing

- Potential for long-term growth

- Dividends provide income

- Opportunity to invest in specific companies and industries

- Lower liquidity compared to Forex

- Limited trading hours

- Vulnerable to company-specific and market-wide risks

Factoid: The oldest stock exchange in the world is the Amsterdam Stock Exchange‚ founded in 1602 by the Dutch East India Company.

FAQ Section

Q: Which market is riskier‚ Forex or the stock market?

A: Both markets carry risk. Forex is generally considered riskier due to the high leverage involved. However‚ stock market investments can also be risky‚ especially with individual stocks.

Q: Which market is better for beginners?

A: It depends on your risk tolerance and financial knowledge. Some argue that the stock market is more accessible for beginners‚ as it involves investing in familiar companies. However‚ thorough research and understanding are essential for both markets.

Q: Can I trade both Forex and stocks?

A: Yes‚ many investors diversify their portfolios by trading both Forex and stocks. This can help spread risk and potentially increase returns.

Q: What resources are available for learning about Forex and the stock market?

A: There are numerous online courses‚ books‚ and articles available. It’s crucial to educate yourself thoroughly before investing in either market.

Q: What is leverage?

A: Leverage is the use of borrowed funds to increase the potential return of an investment. While it can amplify profits‚ it can also amplify losses.