Forex trading, often shortened from Foreign Exchange trading, can seem like a daunting world for newcomers. The sheer volume of information and the fast-paced nature of the market can be overwhelming. However, understanding the fundamental principles of how forex works is crucial for anyone looking to participate in this global marketplace. This article aims to demystify the process, providing a clear and concise explanation of forex trading for beginners, covering everything from basic terminology to practical considerations.

Understanding the Basics of Forex

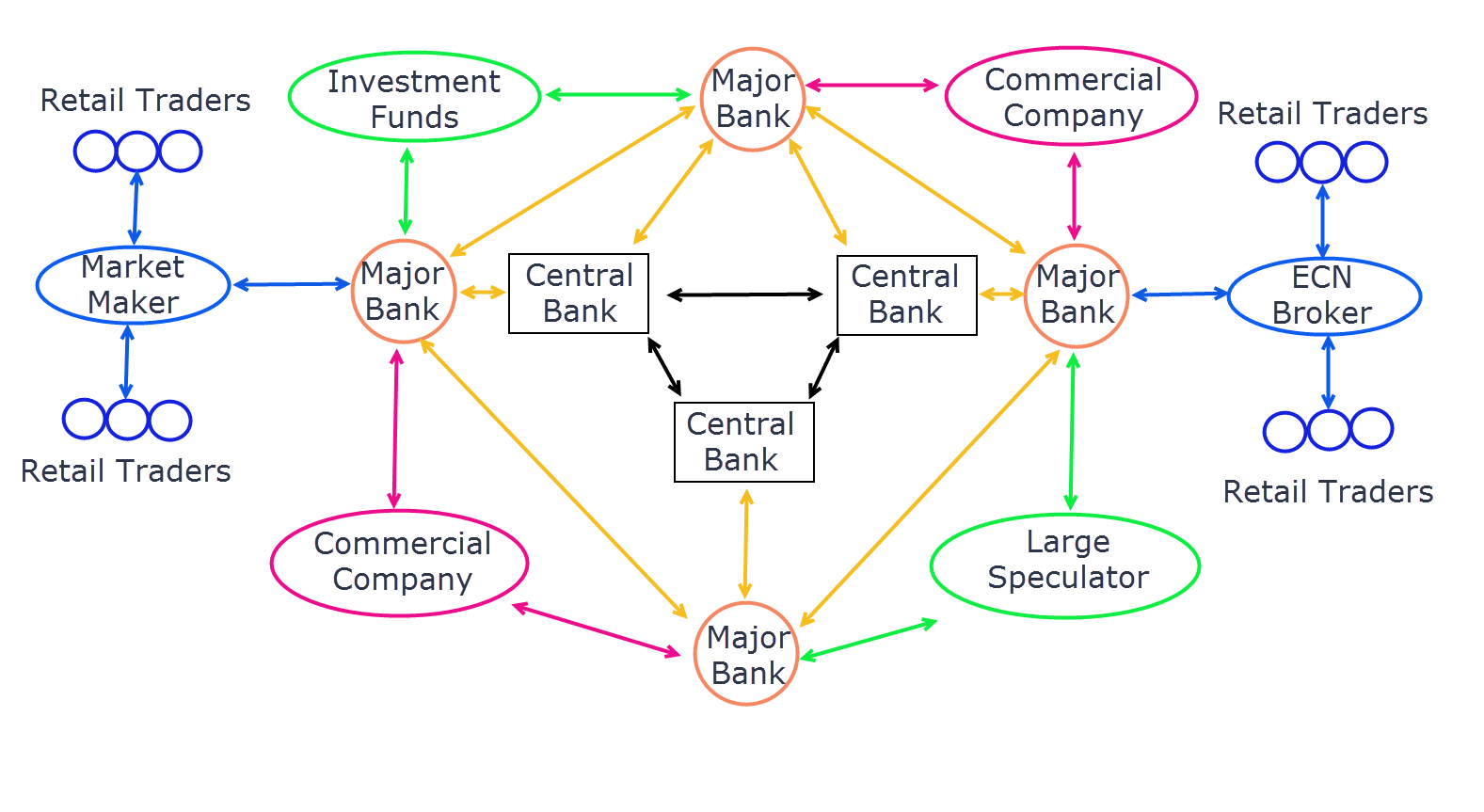

Forex trading involves buying and selling currencies with the goal of profiting from fluctuations in their exchange rates. Unlike stock markets, there’s no central exchange for forex; instead, it’s a decentralized global market where currencies are traded electronically over-the-counter (OTC). This means transactions occur directly between buyers and sellers, creating a 24-hour, five-days-a-week trading environment.

Key Concepts to Grasp

- Currency Pairs: Currencies are always traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is called the base currency, and the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

- Pips (Points in Percentage): A pip is the smallest unit of price movement in a currency pair. Most major currency pairs are priced to four decimal places, so a pip is typically 0.0001.

- Leverage: Forex brokers offer leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also magnify losses, so it’s crucial to use it cautiously.

- Margin: Margin is the amount of money required in your trading account to open and maintain a leveraged position.

The Forex Trading Process

The process of trading forex involves several steps:

1. Choosing a Broker: Select a reputable and regulated forex broker that offers a trading platform, competitive spreads, and reliable customer support.

2. Opening an Account: Complete the broker’s account opening process, which typically involves providing personal information and verifying your identity.

3. Funding Your Account: Deposit funds into your trading account using one of the broker’s accepted payment methods.

4. Analyzing the Market: Use technical and fundamental analysis to identify potential trading opportunities. Technical analysis involves studying price charts and patterns, while fundamental analysis focuses on economic indicators and news events.

5. Placing a Trade: Open a buy (long) or sell (short) order based on your market analysis. A buy order is placed if you believe the price of the currency pair will increase, while a sell order is placed if you believe the price will decrease.

6. Managing Your Trade: Set stop-loss and take-profit orders to limit potential losses and secure profits.

7. Closing Your Trade: Close your open position to realize your profit or loss.

FAQ: Forex Trading for Beginners

- Q: Is forex trading risky?

- A: Yes, forex trading involves significant risk due to leverage and market volatility. It’s essential to manage your risk carefully and only trade with capital you can afford to lose.

- Q: How much money do I need to start trading forex?

- A: The amount of money you need to start trading forex depends on the broker’s minimum deposit requirements and your risk tolerance. Some brokers offer micro accounts that allow you to trade with as little as $100.

- Q: Can I make money trading forex?

- A: Yes, it’s possible to make money trading forex, but it’s not guaranteed. Success in forex trading requires knowledge, skill, discipline, and a well-defined trading strategy.

- Q: What are the best resources for learning about forex trading?

- A: There are many resources available for learning about forex trading, including online courses, books, articles, and webinars. Many brokers also offer educational materials and demo accounts.

Understanding the intricacies of the forex market takes time and dedication. However, by grasping the fundamental concepts and practicing with a demo account, beginners can build a solid foundation for successful currency trading. Remember to always prioritize risk management and continue learning to adapt to the ever-changing market conditions.

Developing a Forex Trading Strategy

Once you understand the basics, the next crucial step is developing a trading strategy. A well-defined strategy provides a framework for making informed trading decisions and helps you avoid impulsive actions driven by emotions. Here are some key elements to consider when developing your strategy:

Identifying Your Trading Style

Scalping: This involves making very short-term trades, often lasting only a few minutes, to profit from small price movements. Scalpers typically make numerous trades throughout the day.

Day Trading: Day traders open and close positions within the same trading day, avoiding overnight exposure.

Swing Trading: Swing traders hold positions for several days or weeks, aiming to capture larger price swings.

Position Trading: Position traders hold positions for weeks, months, or even years, focusing on long-term trends.

Choosing Currency Pairs

Focus on a few currency pairs that you understand well. Consider factors such as volatility, liquidity, and the economic relationship between the countries involved. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, tend to have the highest liquidity and the tightest spreads.

Defining Entry and Exit Rules

Clearly define the conditions that must be met before you enter a trade (entry rules) and the conditions that will trigger you to exit a trade (exit rules). These rules should be based on your market analysis and risk tolerance.

Risk Management

Risk management is paramount in forex trading. Always use stop-loss orders to limit potential losses and determine your position size based on your risk tolerance. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

The Importance of Practice and Patience

Forex trading is not a get-rich-quick scheme. It requires practice, patience, and a willingness to learn from your mistakes. Start with a demo account to practice your trading strategy and familiarize yourself with the trading platform. Don’t be discouraged by initial losses; they are a normal part of the learning process. Analyze your trades, identify areas for improvement, and continuously refine your strategy.

Advanced Forex Trading Techniques

As you gain experience, you can explore more advanced forex trading techniques to enhance your strategies. These techniques require a deeper understanding of market dynamics and risk management.

Technical Indicators

Technical indicators are mathematical calculations based on historical price and volume data. They can provide insights into potential price movements and help you identify trading opportunities. Some popular technical indicators include:

- Moving Averages: Smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

- Fibonacci Retracement: Identifies potential support and resistance levels based on Fibonacci ratios.

Fundamental Analysis

Fundamental analysis involves analyzing economic indicators, news events, and geopolitical factors that can influence currency values. Key economic indicators to watch include:

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in a country.

- Inflation Rate: Measures the rate at which prices are rising in an economy.

- Interest Rates: Set by central banks to control inflation and stimulate economic growth.

- Unemployment Rate: Measures the percentage of the labor force that is unemployed.

- Retail Sales: Measures the total value of sales at the retail level.

Staying informed about these economic indicators and understanding their potential impact on currency values is crucial for successful forex trading.

Trading Psychology

Trading psychology plays a significant role in your success as a forex trader. Emotions such as fear and greed can cloud your judgment and lead to impulsive decisions. It’s essential to develop emotional discipline and stick to your trading plan, even when faced with losses.

Choosing the Right Forex Broker

Selecting the right forex broker is a critical decision that can significantly impact your trading experience. Consider the following factors when choosing a broker:

- Regulation: Ensure the broker is regulated by a reputable regulatory authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

- Trading Platform: Choose a broker that offers a user-friendly and reliable trading platform with the tools and features you need.

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers. Lower spreads and commissions can save you money on each trade.

- Leverage: Consider the leverage offered by the broker. While leverage can amplify profits, it can also magnify losses, so use it cautiously.

- Customer Support: Choose a broker that offers responsive and helpful customer support.

- Deposit and Withdrawal Options: Ensure the broker offers convenient deposit and withdrawal options.