Navigating the world of mortgages can often feel complex, especially when it comes to understanding the details of your interest payments. As a homeowner, knowing how much you’ve paid in mortgage interest is crucial for tax purposes and financial planning. This article will guide you through the process of finding this information, explaining the various resources available and offering tips for tracking your interest payments effectively. Let’s demystify mortgage interest and empower you with the knowledge you need.

Finding Your Mortgage Interest Information

Several resources can help you determine the amount of mortgage interest you paid during a specific year. Here’s a breakdown of the most common methods:

- Form 1098: This is the most reliable source. Your mortgage lender is required to send you Form 1098, Mortgage Interest Statement, by January 31st each year. This form details the total amount of mortgage interest you paid during the previous calendar year.

- Online Account: Most lenders provide online portals where you can access your account information, including your annual interest statements.

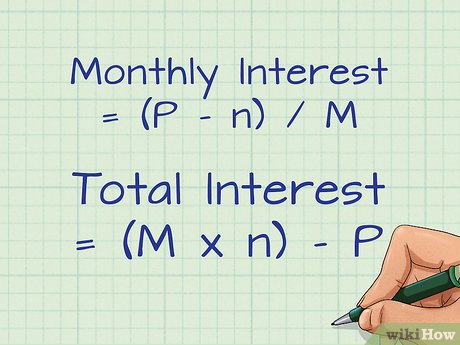

- Monthly Statements: Review your monthly mortgage statements. Each statement typically breaks down the payment into principal, interest, and escrow (if applicable). Summing up the interest portions from each statement will give you the total interest paid for the year.

Decoding Form 1098

Form 1098 is a crucial document for tax purposes. Here’s what you need to know:

- Box 1: This box shows the total mortgage interest you paid to the lender during the year.

- Box 2: This box shows the outstanding mortgage principal as of January 1 of the tax year.

- Box 3: This box indicates whether the mortgage originated after January 1, 2018.

- Other Boxes: Other boxes may contain information about points paid, mortgage insurance premiums, and other relevant details.

Why Knowing Your Mortgage Interest is Important

Understanding your mortgage interest payments is essential for several reasons:

- Tax Deductions: In many cases, you can deduct mortgage interest from your taxable income, potentially reducing your tax liability.

- Financial Planning: Knowing how much you’re paying in interest helps you understand the true cost of your home and plan your finances accordingly.

- Refinancing Decisions: Tracking your interest payments can help you determine if refinancing your mortgage is a beneficial option.

Tips for Tracking Your Mortgage Interest

Here are some helpful tips for keeping track of your mortgage interest payments:

- Keep Records: Organize your Form 1098 and monthly mortgage statements in a safe place.

- Use a Spreadsheet: Create a spreadsheet to track your interest payments each year.

- Utilize Financial Software: Consider using financial software or apps that can automatically track your mortgage interest and other expenses.

Factoid: The mortgage interest deduction has been a part of the U.S. tax code for over 100 years, encouraging homeownership and providing financial relief to homeowners.

FAQ: Mortgage Interest

Q: What if I didn’t receive Form 1098?

A: Contact your mortgage lender immediately. They are required to provide you with this form. You can also access it online in most cases.

Q: Can I deduct all of my mortgage interest?

A: The amount of mortgage interest you can deduct may be limited based on the amount of your mortgage and the tax laws in effect. Consult with a tax professional for personalized advice.

Q: What if I have multiple mortgages?

A: You will receive a Form 1098 for each mortgage. Be sure to keep track of each form and report the interest paid on each mortgage separately.

Q: Where do I report mortgage interest on my tax return?

A: You typically report mortgage interest on Schedule A (Itemized Deductions) of Form 1040.

Q: What is mortgage insurance premium (MIP) and is it deductible?

A: Mortgage insurance premium (MIP) is insurance that protects the lender if you stop making payments on your loan. The deductibility of MIP can vary depending on the tax year and income limits. Check with a tax professional for current regulations.

Q: What if I refinanced my mortgage during the year?

A: You’ll receive Form 1098 from both your old and new lenders, reflecting the interest paid to each during the respective periods they serviced your loan.

Q: My spouse and I own our home jointly. How does the mortgage interest deduction work?

A: If you file jointly, you can deduct the full amount of mortgage interest paid, assuming you meet the eligibility requirements. If you file separately, you’ll typically split the deduction equally, unless you have a written agreement stating otherwise.

Understanding your mortgage interest payments is a vital part of responsible homeownership. By utilizing the resources available to you, such as Form 1098 and online account access, you can easily track your interest payments and make informed financial decisions. Remember to consult with a tax professional for personalized advice on how mortgage interest deductions apply to your specific situation. Being proactive and informed will empower you to manage your mortgage effectively and achieve your financial goals.

Beyond Interest: Other Mortgage-Related Expenses

While mortgage interest is a significant expense, it’s important to be aware of other costs associated with homeownership:

- Property Taxes: These are taxes levied by local governments based on the assessed value of your property.

- Homeowners Insurance: This protects your home against damage from events like fire, storms, and theft.

- Private Mortgage Insurance (PMI): If you put down less than 20% on your home, you may be required to pay PMI.

- Home Maintenance and Repairs: Budgeting for ongoing maintenance and repairs is crucial for preserving the value of your home.

By considering all these factors, you can gain a comprehensive understanding of the true cost of homeownership and plan your finances accordingly. Regularly reviewing your mortgage and related expenses will help you stay on track and make informed decisions about your financial future.