Penny stocks, also known as micro-cap stocks, are shares of small public companies that trade at relatively low prices, typically under $5 per share. They often represent companies with limited operating history or significant financial challenges. Investing in penny stocks can be highly speculative and carries substantial risk, but the potential for high returns also attracts certain investors. This article explores whether Ally Invest, a popular online brokerage platform, allows trading in penny stocks and what considerations investors should keep in mind.

Does Ally Invest Offer Penny Stock Trading?

Yes, Ally Invest does allow its customers to trade penny stocks. However, it’s crucial to understand the risks involved before diving in. While Ally Invest provides access to these markets, they also emphasize the importance of informed decision-making and risk management.

Understanding the Risks

Trading penny stocks comes with a unique set of challenges:

- Limited Liquidity: Penny stocks may have low trading volumes, making it difficult to buy or sell shares quickly at desired prices.

- Price Volatility: Penny stock prices can fluctuate dramatically, leading to significant gains or losses in short periods.

- Lack of Information: Information about penny stock companies may be scarce or unreliable, making it difficult to assess their true value.

- Potential for Fraud: The penny stock market is susceptible to scams and manipulation, which can harm unsuspecting investors.

Key Considerations Before Trading Penny Stocks on Ally Invest

Before engaging in penny stock trading on Ally Invest, consider the following points:

- Research Thoroughly: Conduct extensive research on the companies you are considering investing in. Analyze their financials, business model, and industry outlook.

- Understand the Risks: Be fully aware of the risks associated with penny stock trading and only invest money you can afford to lose.

- Set Realistic Expectations: Don’t expect to get rich quick. Penny stock investing is a long-term game that requires patience and discipline.

- Use Limit Orders: Employ limit orders to control the price at which you buy or sell shares.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes and sectors.

Tips for Responsible Penny Stock Trading

Here are some additional tips for trading penny stocks responsibly:

- Start Small: Begin with a small amount of capital to test the waters.

- Set Stop-Loss Orders: Use stop-loss orders to limit potential losses.

- Monitor Your Investments: Regularly monitor your penny stock holdings and be prepared to adjust your strategy as needed.

- Avoid Overtrading: Don’t trade impulsively or based on emotions.

FAQ: Penny Stock Trading with Ally Invest

Q: What are the fees associated with trading penny stocks on Ally Invest?

A: Ally Invest charges standard commission fees for stock trades, including penny stocks. Check their website for the most up-to-date fee schedule.

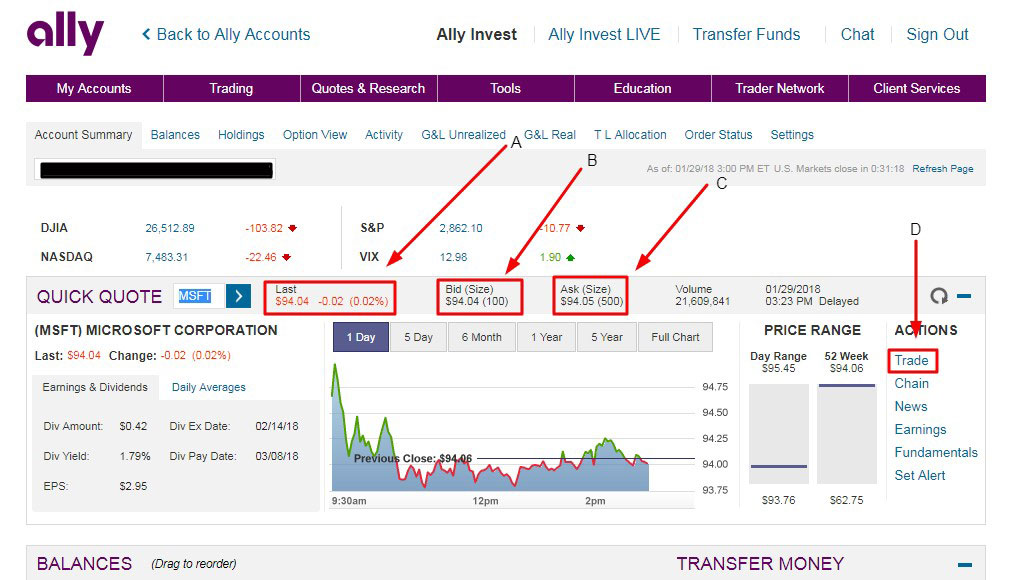

Q: Does Ally Invest provide research tools for penny stocks?

A: While Ally Invest offers research tools, information on penny stocks may be limited compared to larger, more established companies. Supplement their resources with your own independent research.

Q: Can I trade penny stocks in a retirement account with Ally Invest?

A: Yes, you can typically trade penny stocks in a retirement account with Ally Invest, but consider the increased risk and suitability for your overall retirement strategy.

Q: Is penny stock trading suitable for beginners?

A: Penny stock trading is generally not recommended for beginners due to the high risks and complexity involved. It’s best to gain experience with more established investments before venturing into penny stocks.

Q: What are the risks of margin trading penny stocks on Ally Invest?

A: Margin trading penny stocks significantly amplifies both potential gains and losses. Due to the volatility of penny stocks, margin calls can be frequent and substantial, potentially leading to significant financial losses. Use margin with extreme caution, if at all, when trading penny stocks.

While Ally Invest provides a platform for trading penny stocks, it’s essential to approach this market with caution, thorough research, and a clear understanding of the risks involved. Penny stocks can be a volatile and speculative investment, and it’s crucial to manage your risk effectively and only invest what you can afford to lose. Consider consulting with a financial advisor before making any investment decisions.

Remember, successful penny stock trading requires patience, discipline, and a willingness to learn. Don’t be swayed by hype or promises of quick riches. Instead, focus on building a well-diversified investment portfolio that aligns with your financial goals and risk tolerance.