Navigating the world of mortgages can feel like traversing a complex maze‚ filled with unfamiliar terms and procedures․ One common question that arises for homeowners and prospective buyers alike is: do mortgage companies report to the IRS? The answer is yes‚ mortgage companies do indeed report certain information to the Internal Revenue Service (IRS)․ This reporting is crucial for tax compliance and helps the IRS track mortgage interest payments‚ property taxes‚ and other relevant financial details․ Understanding these reporting requirements can empower you to better manage your finances and ensure accurate tax filings․

Why Mortgage Companies Report to the IRS

Mortgage companies are required to report specific information to the IRS for several key reasons:

- Tracking Mortgage Interest: The IRS allows homeowners to deduct mortgage interest payments from their taxable income․ Mortgage companies report the amount of interest paid during the year‚ enabling the IRS to verify these deductions․

- Monitoring Property Taxes: In some cases‚ mortgage companies collect and pay property taxes on behalf of homeowners․ Reporting these payments helps the IRS ensure accurate tax assessments and deductions․

- Preventing Tax Evasion: By tracking mortgage-related transactions‚ the IRS can identify potential instances of tax evasion or fraud․

- Ensuring Compliance: Reporting requirements help ensure that both mortgage companies and homeowners comply with tax laws and regulations․

What Information is Reported?

The specific information that mortgage companies report to the IRS typically includes:

- Borrower’s Name and Social Security Number: This information is used to identify the homeowner and match the reported data to their tax return․

- Property Address: The address of the mortgaged property is reported to link the transaction to a specific location․

- Mortgage Interest Paid: The total amount of mortgage interest paid during the tax year is reported on Form 1098․

- Property Taxes Paid (if applicable): If the mortgage company pays property taxes on behalf of the homeowner‚ the amount paid is also reported․

- Mortgage Insurance Premiums Paid (if applicable): Premiums paid for mortgage insurance may also be reported‚ as they may be deductible under certain circumstances․

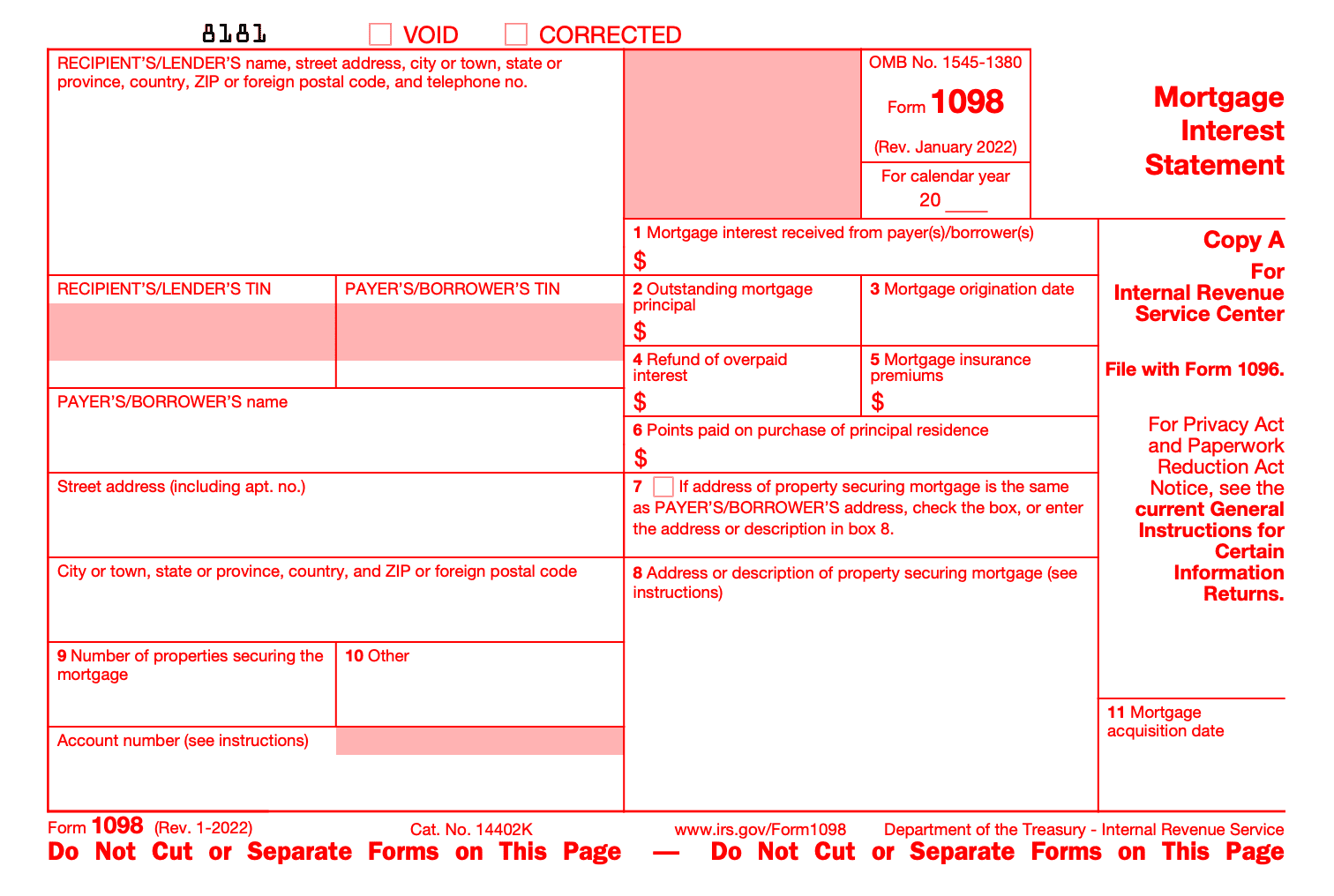

Form 1098: Mortgage Interest Statement

The primary form used for reporting mortgage interest is Form 1098‚ Mortgage Interest Statement․ This form is sent to both the homeowner and the IRS by the mortgage company․ It summarizes the total amount of mortgage interest paid during the year‚ as well as any other relevant information‚ such as property taxes paid․ Homeowners should carefully review Form 1098 when preparing their tax returns to ensure accuracy․ It is important to note that understanding if do mortgage companies report to the IRS is crucial for accurate tax filing․

FAQ: Mortgage Reporting and the IRS

Here are some frequently asked questions about mortgage company reporting to the IRS:

- Q: What if I don’t receive Form 1098?

- A: Contact your mortgage company immediately to request a copy․ You can also access a transcript of your tax information from the IRS website․

- Q: What if the information on Form 1098 is incorrect?

- A: Contact your mortgage company to correct the error․ They will need to issue a corrected Form 1098․

- Q: Are all mortgage companies required to report to the IRS?

- A: Yes‚ most mortgage companies are required to report mortgage interest and other relevant information to the IRS․

- Q: How does this reporting affect my taxes?

- A: The information reported by mortgage companies helps the IRS verify your deductions for mortgage interest and property taxes‚ ensuring accurate tax filings․

Furthermore‚ staying informed about these processes can prevent potential issues with the IRS and ensure a smoother tax season․ By understanding the role mortgage companies play in reporting financial data‚ homeowners can proactively manage their finances and maintain compliance with tax regulations․

Comparative Table: Key Reporting Aspects

| Aspect | Information Reported | Form Used | Purpose |

|---|---|---|---|

| Mortgage Interest | Total interest paid during the year | Form 1098 | Verify homeowner’s deduction |

| Property Taxes (if escrowed) | Total property taxes paid by the mortgage company | Form 1098 | Verify homeowner’s deduction |

| Borrower Information | Name‚ Social Security Number‚ Property Address | Form 1098 | Identify the homeowner and property |

Beyond Form 1098: Other Potential Reporting

While Form 1098 is the most common form associated with mortgage reporting‚ there might be other instances where mortgage companies report information to the IRS․ For example‚ if a homeowner experiences a foreclosure or debt forgiveness‚ the mortgage company may be required to report this information on Form 1099-C‚ Cancellation of Debt; This form reports the amount of debt that was forgiven‚ which may be considered taxable income for the homeowner․ It’s crucial to understand the implications of such reporting and consult with a tax professional if you experience a foreclosure or debt forgiveness․

Ultimately‚ the relationship between mortgage companies and the IRS is designed to ensure transparency and accuracy in financial reporting․ Homeowners who are aware of these reporting requirements can better manage their tax obligations and avoid potential complications․ Therefore‚ understanding if do mortgage companies report to the IRS is not just a matter of curiosity‚ but a key element of responsible financial management․

The complexities of mortgage reporting can seem daunting‚ but understanding the basics empowers homeowners to navigate the tax landscape with confidence․ By staying informed and proactive‚ you can ensure accurate tax filings and avoid potential issues with the IRS․ Remember to keep detailed records of all mortgage-related transactions and consult with a tax professional if you have any questions or concerns․

Tips for Homeowners: Staying on Top of Mortgage Reporting

Here are some practical tips for homeowners to stay organized and informed regarding mortgage reporting:

- Keep Accurate Records: Maintain copies of all mortgage statements‚ property tax bills‚ and other relevant documents․

- Review Form 1098 Carefully: Upon receiving Form 1098‚ carefully review the information for accuracy․ Contact your mortgage company immediately if you find any errors․

- Understand Deductible Expenses: Familiarize yourself with the deductible expenses related to your mortgage‚ such as mortgage interest‚ property taxes‚ and mortgage insurance premiums (if applicable)․

- Consult a Tax Professional: If you have complex tax situations or are unsure about any aspect of mortgage reporting‚ consult with a qualified tax professional․

- Stay Updated on Tax Laws: Tax laws and regulations can change‚ so stay informed about any updates that may affect your mortgage-related deductions․

The Future of Mortgage Reporting

The landscape of mortgage reporting is constantly evolving‚ driven by technological advancements and changes in tax regulations․ We may see increased automation and digitization of reporting processes in the future‚ making it easier for both mortgage companies and homeowners to manage their tax obligations․ Furthermore‚ there may be greater emphasis on data security and privacy‚ ensuring that sensitive financial information is protected․

Comparative Table: Common Mortgage-Related Tax Deductions

| Deduction | Description | Requirements | Form Used |

|---|---|---|---|

| Mortgage Interest | Deduction for interest paid on a home mortgage․ | Must itemize deductions; limitations may apply based on loan amount and filing status․ | Schedule A (Form 1040) |

| Property Taxes | Deduction for property taxes paid on your home․ | Must itemize deductions; subject to a limit of $10‚000 for state and local taxes (SALT)․ | Schedule A (Form 1040) |

| Mortgage Insurance Premiums (PMI) | Deduction for premiums paid for private mortgage insurance․ | Subject to income limitations; may not be deductible for higher-income taxpayers․ | Schedule A (Form 1040) |