Navigating the complexities of credit scores can be daunting, especially when unexpected medical bills arise. Many individuals find themselves wondering, “Do medical debts affect your credit score?” The answer, while seemingly straightforward, involves nuances related to reporting practices and credit scoring models. Understanding how medical debt interacts with your credit report is crucial for maintaining financial health and avoiding unnecessary credit score damage. Let’s delve into the specifics of medical debt and its potential impact on your creditworthiness.

Understanding Medical Debt and Credit Reporting

Medical debt differs from other types of debt, such as credit card debt or loans, in several key ways. The most significant difference lies in how it’s reported to credit bureaus.

- HIPAA Protections: Medical information is protected by HIPAA, meaning healthcare providers cannot directly share your medical details with credit bureaus.

- Collection Agency Involvement: Medical debt typically only appears on your credit report if it’s sent to a collection agency.

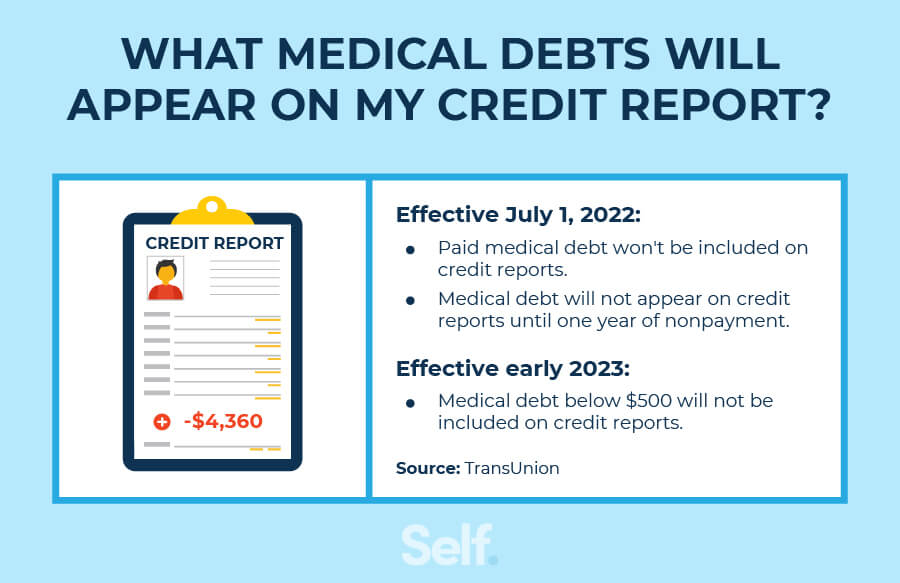

- Grace Period: Credit bureaus generally provide a grace period before reporting medical debt, allowing time for insurance claims to be processed or payment arrangements to be made.

How Medical Debt Can Impact Your Credit Score

While medical debt isn’t automatically reported, it can still negatively affect your credit score under certain circumstances.

- Debt in Collections: If medical debt remains unpaid and is sent to a collection agency, it can be reported to credit bureaus and appear on your credit report.

- Credit Scoring Models: Different credit scoring models treat medical debt differently. Some models may give less weight to medical debt compared to other types of debt.

- Impact on Credit Utilization: Although medical debt isn’t directly factored into credit utilization ratios (like credit card balances), it can still affect your overall debt-to-income ratio, which lenders consider.

Protecting Your Credit Score from Medical Debt

There are several steps you can take to minimize the impact of medical debt on your credit score:

- Verify Your Bills: Carefully review all medical bills for accuracy and ensure that your insurance company has processed the claim correctly.

- Negotiate Payment Plans: Contact your healthcare provider to discuss payment plan options or potential discounts;

- Address Errors Promptly: If you find any errors on your credit report related to medical debt, dispute them immediately with the credit bureau.

- Pay Off Debt Quickly: Prioritize paying off medical debt as quickly as possible to prevent it from being sent to collections.

FAQ: Medical Debt and Credit Scores

Q: How long does medical debt stay on my credit report?

A: Like other types of debt in collections, medical debt can remain on your credit report for up to seven years from the date of the original delinquency.

Q: Will paying off medical debt improve my credit score?

A: Yes, paying off medical debt can improve your credit score, especially if it was previously in collections. Some credit scoring models may also give you a boost for resolving outstanding debt.

Q: What if my insurance company is disputing a medical bill?

A: If your insurance company is disputing a medical bill, keep detailed records of all communication and documentation. Contact the healthcare provider and collection agency (if applicable) to inform them of the dispute and request a hold on collection activities until the issue is resolved.

Q: Are there any laws protecting consumers from unfair medical debt collection practices?

A: Yes, the Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive, unfair, and deceptive debt collection practices; You have the right to request validation of the debt, dispute the debt, and request that the collection agency cease communication.

Comparative Table: Medical Debt vs. Other Debt Types

| Feature | Medical Debt | Credit Card Debt | Loan Debt |

|---|---|---|---|

| Reporting to Credit Bureaus | Typically reported only if sent to collections | Reported monthly, regardless of collection status | Reported monthly, regardless of collection status |

| Grace Period | Often a grace period before reporting | No grace period; late payments reported quickly | No grace period; late payments reported quickly |

| HIPAA Protection | Protected by HIPAA | Not protected by HIPAA | Not protected by HIPAA |

Ultimately, understanding the nuances of how medical debt affects your credit score is essential for proactive financial management. While the impact may not be as immediate as with other types of debt, neglecting medical bills can still lead to negative consequences. Therefore, it’s crucial to stay informed, communicate with healthcare providers and insurance companies, and address any issues promptly. Remember, understanding “do medical debts affect your credit score” is the first step towards protecting your financial well-being.

Navigating the Complexities of Credit Scoring Models

Credit scoring models, such as FICO and VantageScore, are constantly evolving; While both models consider medical debt, they may weigh it differently compared to other types of debt. It’s important to understand that there isn’t a single, universal credit score. Your score can vary depending on the model used and the information available on your credit report at a given time.

FICO and Medical Debt

FICO scores are widely used by lenders. Recent versions of the FICO scoring model, such as FICO 9 and FICO 10, treat medical debt more leniently than older versions. These newer models tend to give less weight to medical debt that is in collections, especially if it has been paid off. However, unpaid medical debt can still negatively impact your FICO score, particularly if it’s a significant amount.

VantageScore and Medical Debt

VantageScore is another popular credit scoring model. Similar to FICO, VantageScore models have evolved to be more forgiving of medical debt. VantageScore 3.0 and 4.0, for example, are designed to ignore medical debt that has been paid off, even if it was previously in collections. This can be a significant benefit for individuals who have resolved their medical debt issues.

Beyond Credit Scores: The Broader Financial Impact

While the direct impact on your credit score is a primary concern, medical debt can also have broader financial implications. Unpaid medical bills can lead to legal action, such as lawsuits and wage garnishments. This can further damage your credit and create significant financial hardship. Furthermore, the stress and anxiety associated with medical debt can negatively impact your overall well-being.

Resources for Managing Medical Debt

Fortunately, there are numerous resources available to help individuals manage medical debt:

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost credit counseling services, including assistance with budgeting, debt management, and negotiating with creditors.

- Patient Advocacy Groups: Many patient advocacy groups provide resources and support for navigating the healthcare system and managing medical bills.

- Government Agencies: The Consumer Financial Protection Bureau (CFPB) offers valuable information and resources on managing debt and protecting your financial rights.

- Hospital Financial Assistance Programs: Many hospitals offer financial assistance programs to help patients who are struggling to afford their medical bills.

The Future of Medical Debt and Credit Reporting

The landscape of medical debt and credit reporting is constantly evolving. There is growing recognition of the unique challenges posed by medical debt and the need for more consumer-friendly policies. Some policymakers are advocating for changes to credit reporting practices to further protect consumers from the negative impacts of medical debt. As awareness grows, we may see further reforms aimed at mitigating the impact of medical debt on credit scores and overall financial well-being. It’s crucial to stay informed about these developments and advocate for policies that promote fairness and transparency in the credit reporting system. Understanding the complexities of medical debt and its potential impact is paramount, and proactive steps can significantly safeguard your financial future. Remember that even though medical debt can be a burden, there are resources and strategies available to help you navigate these challenges and maintain a healthy credit profile.