SoFi, initially known for student loan refinancing, has significantly expanded its financial services offerings․ Today, SoFi provides a comprehensive platform for banking, lending, and, importantly, investing․ If you’re wondering whether you can invest in stocks through SoFi, the answer is a resounding yes․ This guide will walk you through the investment options available on SoFi, how to get started, and some key considerations before you dive in․

SoFi Invest: Your Gateway to the Stock Market

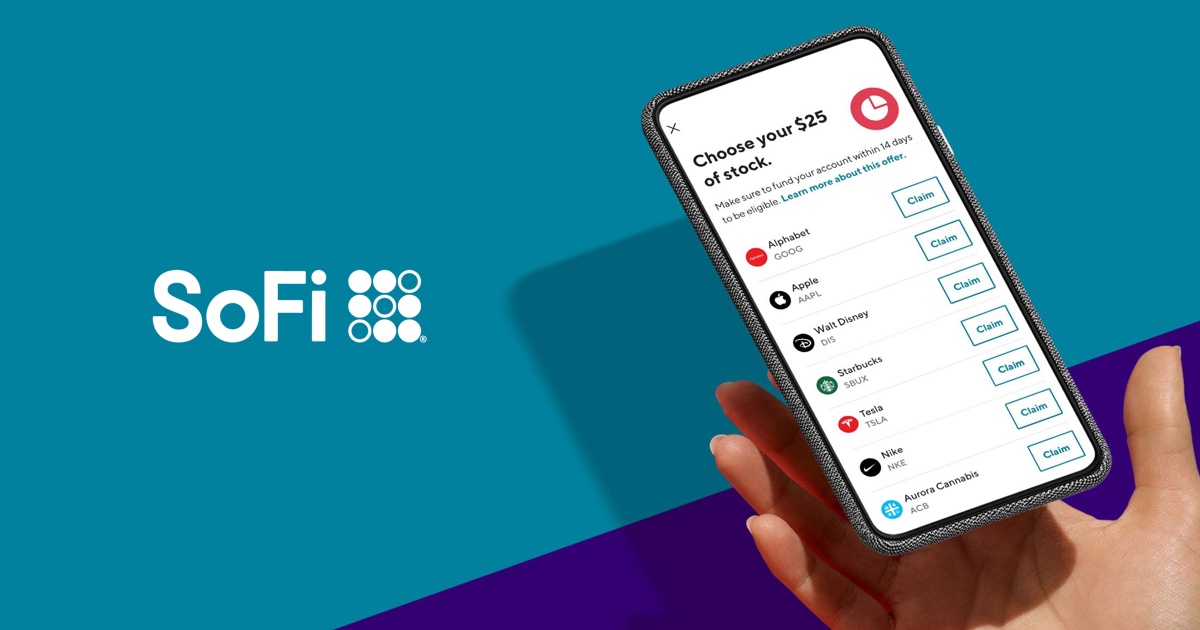

SoFi Invest is SoFi’s platform dedicated to helping users buy and sell stocks, ETFs, and even cryptocurrency․ It offers different investment options catering to various risk tolerances and investment styles․

Active Investing

With Active Investing, you have complete control over your investment decisions․ You can buy and sell individual stocks and ETFs (Exchange Traded Funds) commission-free․ This option is suitable for those who are comfortable researching companies and managing their own portfolios․

Key features of Active Investing:

- Commission-free trading

- Access to stocks and ETFs

- Real-time market data

- Ability to manage your own portfolio

Automated Investing

Automated Investing, also known as robo-advising, is ideal for those who prefer a hands-off approach․ SoFi’s algorithm builds and manages a diversified portfolio based on your risk tolerance, investment goals, and time horizon․ You simply deposit funds, and SoFi takes care of the rest․

Key features of Automated Investing:

- Algorithm-driven portfolio management

- Diversified portfolio based on your risk profile

- Automatic rebalancing

- Tax-loss harvesting (may be available)

SoFi ETFs

SoFi also offers its own range of ETFs, designed to align with specific investment themes or strategies․ These ETFs can be traded commission-free on the SoFi platform․

Factoid: SoFi was founded in 2011 by four Stanford Business School students․ Their initial focus was on providing more affordable student loan refinancing options․

How to Get Started with SoFi Invest

Opening a SoFi Invest account is a straightforward process:

- Create a SoFi Account: Visit the SoFi website or download the mobile app and create an account․

- Fund Your Account: Link your bank account and transfer funds to your SoFi Invest account․

- Choose Your Investment Style: Decide whether you want to use Active Investing or Automated Investing․

- Start Investing: If you choose Active Investing, research and select the stocks or ETFs you want to buy․ If you choose Automated Investing, complete the risk assessment questionnaire, and SoFi will build your portfolio․

Important Considerations Before Investing

Before you start investing with SoFi or any other platform, it’s crucial to consider the following:

- Risk Tolerance: Understand your risk tolerance and choose investments that align with it․

- Investment Goals: Define your investment goals (e․g․, retirement, down payment on a house) and choose investments that help you achieve them․

- Time Horizon: Consider your time horizon (how long you plan to invest)․ Longer time horizons typically allow for greater risk․

- Diversification: Diversify your portfolio to reduce risk․

- Fees and Expenses: Understand the fees and expenses associated with SoFi Invest, although many options are commission-free;

FAQ About Investing with SoFi

Q: Is SoFi Invest safe?

A: SoFi Invest is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash)․ It’s important to note that SIPC protection does not protect against market losses․

Q: What is the minimum investment required to start investing with SoFi?

A: SoFi allows you to get started with as little as $1 for certain investments, particularly with fractional shares․

Q: Can I transfer my existing investment account to SoFi?

A: Yes, SoFi allows you to transfer existing investment accounts from other brokerages․

Q: Does SoFi offer educational resources for investors?

A: Yes, SoFi provides a range of educational resources, including articles, webinars, and calculators, to help you learn about investing․

Q: What happens if I need to withdraw my money from my SoFi Invest account?

A: You can typically withdraw your money from your SoFi Invest account, although it may take a few business days for the funds to become available․

Investing in the stock market can be a powerful way to grow your wealth over time․ With SoFi Invest, you have access to different investment options to suit your needs and preferences․ Remember to do your research, understand your risk tolerance, and invest responsibly․

Understanding SoFi’s Investment Tools

SoFi provides a suite of tools designed to help both novice and experienced investors make informed decisions․ These tools can assist in researching stocks, analyzing market trends, and managing your portfolio effectively․

Stock Screener

SoFi’s stock screener allows you to filter stocks based on various criteria, such as market capitalization, dividend yield, price-to-earnings ratio, and more․ This tool can help you identify potential investment opportunities that align with your investment strategy․

Market Insights

SoFi provides access to market insights and analysis, keeping you informed about the latest market trends and news․ This information can help you make more informed investment decisions․

Performance Tracking

SoFi offers tools to track the performance of your portfolio, allowing you to monitor your gains and losses over time․ This can help you assess the effectiveness of your investment strategy and make adjustments as needed․

Factoid: SoFi Stadium, home to the Los Angeles Rams and Los Angeles Chargers, is named after the company, highlighting SoFi’s commitment to brand visibility and expansion․

Tax Implications of Investing with SoFi

It’s crucial to understand the tax implications of your investment activities on SoFi․ Here are some key considerations:

- Capital Gains Tax: When you sell stocks or ETFs for a profit, you may be subject to capital gains tax․ The tax rate depends on how long you held the investment (short-term vs․ long-term)․

- Dividends: Dividends you receive from stocks or ETFs are generally taxable as ordinary income or qualified dividends, depending on the type of dividend and your tax bracket․

- Tax-Loss Harvesting: SoFi’s Automated Investing platform may offer tax-loss harvesting, which involves selling losing investments to offset capital gains and reduce your tax liability․

- Form 1099: SoFi will provide you with a Form 1099 at the end of the year, summarizing your investment income and capital gains for tax reporting purposes․

Comparing SoFi Invest to Other Investment Platforms

When choosing an investment platform, it’s important to compare SoFi Invest to other options available in the market; Consider factors such as fees, investment options, features, and customer support․

Here’s a brief comparison:

- SoFi vs․ Traditional Brokerages: SoFi often offers lower fees and a more user-friendly interface compared to traditional brokerages․

- SoFi vs․ Other Robo-Advisors: SoFi’s Automated Investing platform is competitive with other robo-advisors, offering similar features and performance․

- SoFi vs; Cryptocurrency Exchanges: While SoFi offers cryptocurrency trading, it’s important to note that it’s not a dedicated cryptocurrency exchange and may have limited options compared to specialized platforms․

Advanced Strategies for SoFi Investors

Once you’re comfortable with the basics of investing on SoFi, you can explore more advanced strategies to potentially enhance your returns․

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price․ This strategy can help reduce the risk of investing a large sum of money at the wrong time․

Options Trading

SoFi offers options trading for experienced investors․ Options trading involves buying and selling contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a specific date․ This strategy can be highly risky and is not suitable for beginners․

Margin Trading

SoFi also offers margin trading, which allows you to borrow money from SoFi to invest in stocks or ETFs․ Margin trading can amplify your gains, but it can also amplify your losses․ It’s important to understand the risks involved before engaging in margin trading․

Final Thoughts

SoFi Invest provides a convenient and accessible platform for investing in the stock market and other assets․ Whether you’re a beginner or an experienced investor, SoFi offers a range of tools and options to help you achieve your financial goals․ Remember to do your research, understand the risks involved, and invest responsibly․