Understanding and calculating your maximum lot size in Forex trading is crucial for effective risk management and protecting your capital. Many novice traders jump into the Forex market without properly understanding position sizing‚ often leading to significant losses. This guide provides a step-by-step approach to calculating your maximum lot size‚ ensuring you trade responsibly and within your risk tolerance. By carefully considering your account balance‚ risk appetite‚ and the specific currency pair you’re trading‚ you can significantly improve your trading outcomes.

Understanding the Basics

Before diving into the calculation‚ it’s important to grasp the fundamental concepts involved:

- Account Balance: The total amount of money in your trading account.

- Risk Percentage: The percentage of your account balance you’re willing to risk on a single trade. A common starting point is 1-2%.

- Stop-Loss: The price level at which you will automatically exit a trade to limit potential losses.

- Pip Value: The monetary value of one pip (percentage in point) movement for a specific currency pair and lot size.

- Lot Size: The standardized unit of trade in Forex. A standard lot is 100‚000 units of the base currency.

The Formula for Maximum Lot Size

The formula for calculating your maximum lot size is:

Lot Size = (Account Balance * Risk Percentage) / (Stop-Loss in Pips * Pip Value per Lot)

Step-by-Step Calculation

- Determine Your Account Balance: Know exactly how much money you have in your trading account. For example‚ let’s say you have $5‚000.

- Decide on Your Risk Percentage: Choose the percentage of your account you’re willing to risk per trade. Let’s assume you choose 2%. This means you’re willing to risk $100 per trade ($5‚000 * 0.02 = $100).

- Set Your Stop-Loss: Determine where you will place your stop-loss order for the trade. This is based on your technical analysis and market conditions. Let’s say you set your stop-loss at 50 pips.

- Find the Pip Value: Find out the pip value for the currency pair you are trading. This depends on the lot size and the currency pair itself. Consult your broker for accurate pip values. For EUR/USD‚ a standard lot typically has a pip value of $10.

- Calculate the Maximum Lot Size: Plug the values into the formula: Lot Size = ($5‚000 * 0.02) / (50 pips * $10) = $100 / $500 = 0.2 lots.

Therefore‚ in this example‚ your maximum lot size would be 0.2 lots.

Adjusting for Different Currency Pairs

Pip values vary between currency pairs. Pairs involving the Japanese Yen (JPY) are calculated differently. Always check with your broker for the exact pip value for the specific currency pair you are trading.

Example with USD/JPY

Let’s say you are trading USD/JPY and the pip value for a standard lot is $9.00. Using the same example as above (Account Balance: $5‚000‚ Risk Percentage: 2%‚ Stop-Loss: 50 pips)‚ the calculation would be:

Lot Size = ($5‚000 * 0.02) / (50 pips * $9.00) = $100 / $450 = 0.22 lots.

Important Considerations

- Leverage: While leverage can amplify profits‚ it also magnifies losses. Use leverage cautiously and ensure you understand the risks involved.

- Volatility: Highly volatile currency pairs require wider stop-losses‚ which will affect your maximum lot size.

- Trading Strategy: Different trading strategies may require different risk parameters. Adjust your risk percentage accordingly.

FAQ — Frequently Asked Questions

What happens if I exceed my maximum lot size?

Exceeding your maximum lot size increases your risk exposure. A small adverse price movement could result in significant losses‚ potentially wiping out your account.

How often should I recalculate my maximum lot size?

You should recalculate your maximum lot size whenever your account balance changes significantly‚ or if you adjust your risk percentage or trading strategy.

Is a 2% risk percentage always appropriate?

No. The appropriate risk percentage depends on your risk tolerance‚ trading experience‚ and the specific trading strategy you are using. Beginners should typically start with a lower risk percentage (e.g.‚ 1%).

Where can I find the pip value for a specific currency pair?

Your Forex broker should provide accurate pip values for all the currency pairs they offer. You can often find this information on their trading platform or website.

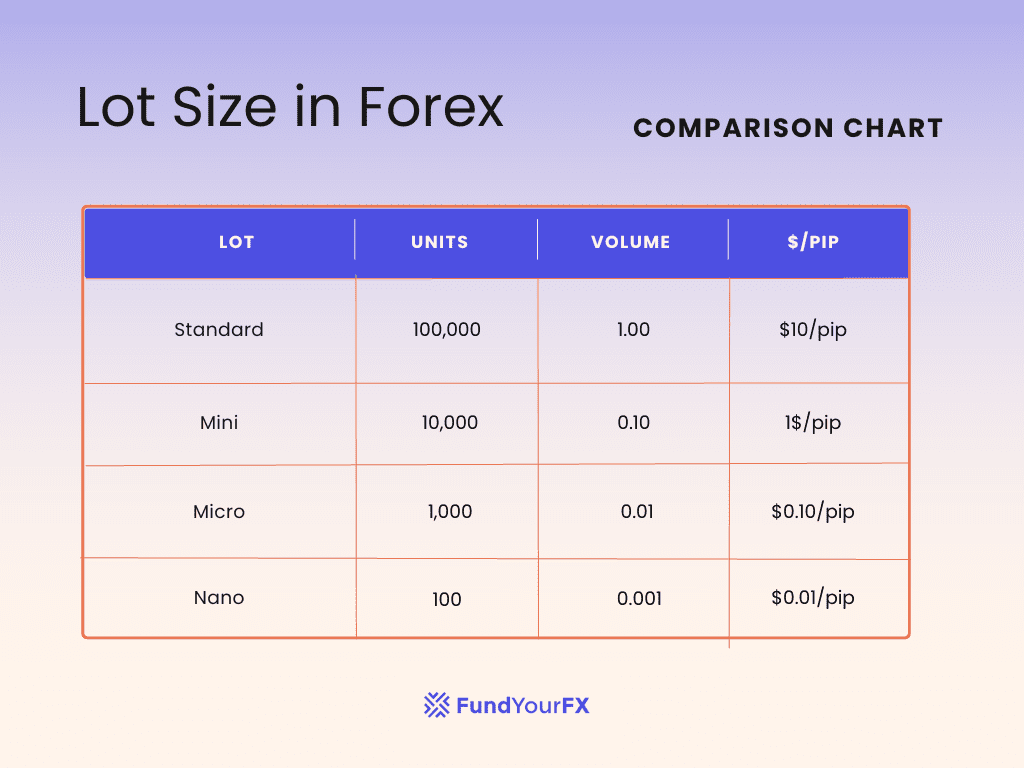

What is the difference between a standard lot‚ a mini lot‚ and a micro lot?

A standard lot is 100‚000 units of the base currency‚ a mini lot is 10‚000 units‚ and a micro lot is 1‚000 units. These different lot sizes allow traders with smaller accounts to participate in the Forex market.

Advanced Risk Management Techniques

Beyond simply calculating your maximum lot size‚ consider these advanced risk management techniques to further protect your capital:

- Diversification: Avoid putting all your capital into a single trade or currency pair. Diversify your portfolio to spread your risk across multiple assets.

- Correlation Awareness: Be aware of correlations between currency pairs. Trading highly correlated pairs can effectively increase your risk exposure.

- Hedging: Use hedging techniques to offset potential losses. This involves taking opposing positions in related assets.

- Trailing Stop-Loss: A trailing stop-loss order adjusts automatically as the price moves in your favor‚ locking in profits while limiting potential losses.

- Risk-Reward Ratio: Always consider the risk-reward ratio of a trade before entering. Aim for trades where the potential profit outweighs the potential loss. A common target is a 1:2 or 1:3 risk-reward ratio.

The Importance of Emotional Control

Even with the best risk management plan‚ emotional control is crucial. Fear and greed can lead to impulsive decisions that undermine your carefully calculated lot sizes and stop-loss orders. Stick to your trading plan and avoid chasing losses or letting winning trades run too long out of greed.

Choosing the Right Broker

The right broker can significantly impact your trading success. Look for a broker that offers:

- Tight Spreads: Lower spreads reduce your trading costs.

- Reliable Execution: Fast and reliable trade execution minimizes slippage.

- Regulated Status: Choose a broker regulated by a reputable financial authority.

- Good Customer Support: Responsive and helpful customer support is essential for resolving any issues that may arise.

- Variety of Account Types: Different account types offer varying levels of leverage and minimum deposit requirements. Choose one that suits your trading style and capital.

Leverage Explained Further

Leverage is a double-edged sword. It allows you to control a larger position with a smaller amount of capital. For example‚ with 100:1 leverage‚ you can control $100‚000 worth of currency with only $1‚000. However‚ remember that both profits and losses are magnified by the leverage ratio. While it can increase your potential gains‚ it also significantly increases your risk of substantial losses. Therefore‚ use leverage judiciously and always prioritize risk management.

Factoid: The leverage offered by Forex brokers can vary significantly‚ from as low as 1:1 to as high as 500:1 or even higher in some unregulated jurisdictions. Be extremely cautious when using high leverage.

Developing a Trading Plan

A well-defined trading plan is essential for success in Forex trading. Your trading plan should include:

- Trading Goals: Define your financial goals and objectives for trading Forex.

- Risk Tolerance: Determine your risk tolerance and how much you are willing to risk per trade.

- Trading Strategy: Develop a specific trading strategy based on technical or fundamental analysis.

- Entry and Exit Rules: Establish clear rules for entering and exiting trades.

- Money Management Rules: Define your money management rules‚ including your maximum lot size‚ stop-loss levels‚ and risk-reward ratio.

- Record Keeping: Keep detailed records of all your trades‚ including entry and exit prices‚ stop-loss levels‚ and profits or losses. This will help you analyze your performance and identify areas for improvement.

Staying Informed and Adaptable

The Forex market is constantly evolving. Stay informed about market news‚ economic events‚ and geopolitical developments that could impact currency prices. Be prepared to adapt your trading plan and risk management strategies as market conditions change.

Calculating your maximum lot size is a fundamental aspect of responsible Forex trading. By understanding the principles of risk management‚ using the correct formulas‚ and controlling your emotions‚ you can significantly increase your chances of success in the Forex market. Remember that consistent profitability requires discipline‚ patience‚ and a commitment to continuous learning.