The question of whether bankruptcy clears credit card debts is a common one, fraught with complexities and nuances that depend heavily on individual circumstances and the specific type of bankruptcy filed. Many individuals struggling under the weight of overwhelming credit card balances see bankruptcy as a potential lifeline, a way to escape the relentless cycle of debt. Understanding the intricacies of this process is crucial before making such a significant financial decision. Therefore, exploring the relationship between bankruptcy and credit card debt requires a thorough examination of the different bankruptcy chapters and their implications.

Understanding Bankruptcy and Credit Card Debt

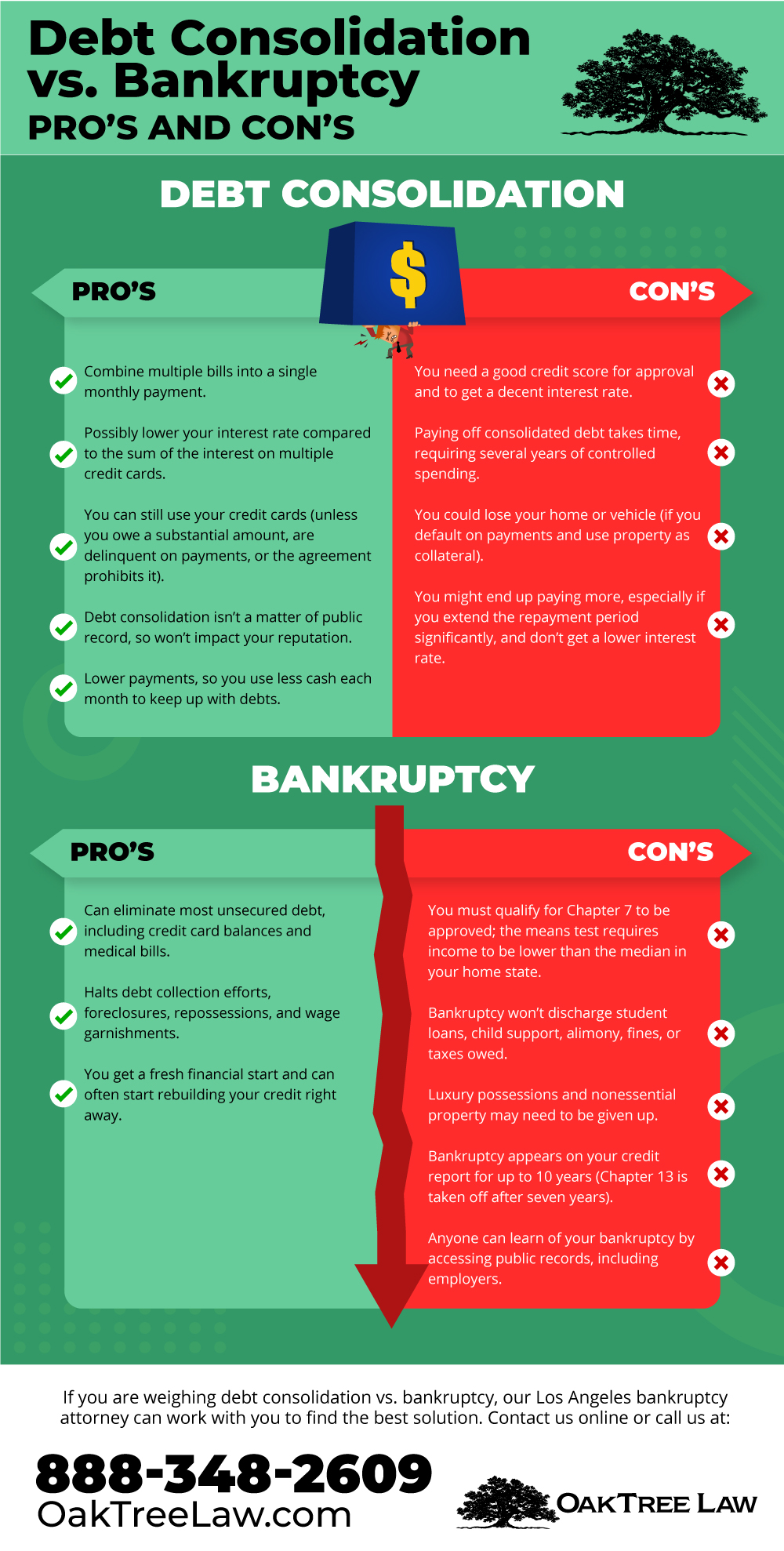

Bankruptcy is a legal process designed to provide individuals and businesses facing insurmountable debt with a fresh start. It offers a framework for either liquidating assets to repay creditors or creating a repayment plan that allows debtors to manage their obligations over time. Credit card debt, being a form of unsecured debt, is generally dischargeable in bankruptcy, but there are exceptions and conditions that must be met.

Types of Bankruptcy and Their Impact on Credit Card Debt

The two most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. Each handles credit card debt differently:

Chapter 7 Bankruptcy: Often referred to as “liquidation bankruptcy,” Chapter 7 involves selling off non-exempt assets to pay creditors. Credit card debt is typically discharged in Chapter 7, meaning the debtor is no longer legally obligated to repay it. However, certain debts, such as those incurred through fraud or luxury purchases made shortly before filing, may not be dischargeable.

Chapter 13 Bankruptcy: This is a “reorganization bankruptcy” where the debtor proposes a repayment plan to creditors over a period of three to five years. While credit card debt is included in the repayment plan, the debtor may not have to repay the full amount. Upon successful completion of the plan, the remaining credit card debt is discharged.

Factors Affecting Dischargeability of Credit Card Debt

Several factors can influence whether credit card debt is discharged in bankruptcy:

Fraudulent Charges: If you incurred credit card debt through fraudulent means, such as making purchases with no intention of repaying, the debt may not be dischargeable.

Luxury Purchases: Charges for luxury goods or services made within a certain timeframe (typically 90 days) before filing bankruptcy may be challenged by creditors and deemed non-dischargeable.

Cash Advances: Similar to luxury purchases, large cash advances taken shortly before filing bankruptcy can also be considered non-dischargeable.

Failure to List Creditors: It’s crucial to list all creditors in your bankruptcy filing; If a creditor is not properly notified, the debt may not be discharged.

Navigating the Bankruptcy Process

Filing for bankruptcy is a complex process that requires careful planning and attention to detail. It’s highly recommended to consult with a qualified bankruptcy attorney to understand your options and ensure you comply with all legal requirements.

Here’s a general overview of the steps involved:

Credit Counseling: You’ll typically need to complete a credit counseling course before filing for bankruptcy.

Filing the Petition: This involves submitting a detailed petition to the bankruptcy court, including information about your assets, liabilities, income, and expenses.

Meeting of Creditors: You’ll attend a meeting where creditors can ask you questions about your financial situation.

Discharge: If all requirements are met, the court will issue a discharge order, releasing you from your obligation to repay certain debts, including most credit card debts.

FAQ: Bankruptcy and Credit Card Debt

Q: Will bankruptcy erase all my credit card debt?

- A: Generally, yes, but there are exceptions for fraudulent charges, luxury purchases, and other specific circumstances.

Q: How long does bankruptcy stay on my credit report?

- A: Chapter 7 bankruptcy remains on your credit report for 10 years, while Chapter 13 stays for 7 years.

Q: Can I rebuild my credit after bankruptcy?

- A: Yes, it’s possible to rebuild your credit after bankruptcy by practicing responsible financial habits, such as paying bills on time and keeping credit card balances low.

Q: Do I need a lawyer to file for bankruptcy?

- A: While not legally required, it’s highly recommended to consult with a bankruptcy attorney to navigate the complex legal process.

Ultimately, understanding whether bankruptcy clears credit card debts requires careful consideration of your individual circumstances and the specific details of your debt. Seeking professional legal advice is essential to making informed decisions and achieving the best possible outcome for your financial future.